Founded in 1771, Vienna Stock Exchange is one of the oldest and more established independent exchanges in Europe. At its inception, it was mostly focused on the debt market, providing an invaluable platform for bond trading. To this day, Vienna Stock Exchange has kept its tradition of focussing on customer and market needs making it a vibrant listing hub for the European debt capital markets community.

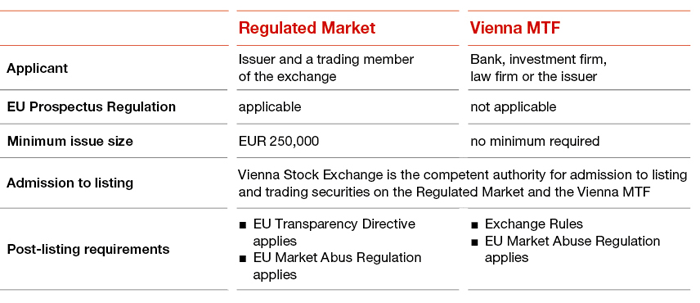

We operate two markets offering issuers increased visibility and tradability of their securities:

an EU-regulated market ("Amtlicher Handel")

an exchange-regulated multilateral trading facility ("Vienna MTF")

We have many years of listing experience in our team and our focus is always on providing a smooth listing process. Our growing number of international partners are particularly attracted to our flexibility in accommodating their needs and how we bring a "can do" attitude to life.

Let's get started

Our listing experts look forward to helping you achieve your listing requirements with unmatched response times and a process you can trust.