All decisions regarding periodic adjustments and changes of an index composition are based on the index rules, presented to the index committee (decision making body) and implemented by the index management. The decisions taken by the index committee as well as the date of their implementation are published immediately after the committee meetings.

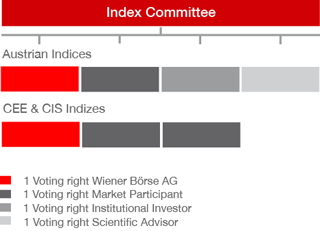

The index committee is composed of:

March / June / September / December

Quarterly review and adjustment of the calculation values (number of shares, FFF, RF)

March / September

Semi-annual committee meetings and decisions regarding changes in the index compositions

Ordinary adjustments (periodical adjustments) are implemented after the close of trading on the last trading day of index derivatives (expiry date is normally the third Friday every month)

Austrian indices

The bi-annual review of the index composition of the ATX is made on the basis of the monthly watchlist. The watchlist ranks all stocks traded on the prime market according to the selection criteria of liquidity (stock exchange trading volume in money terms) and capitalized free float. A stock qualifies for inclusion in the ATX if it ranks among the 25 most actively traded stocks in the prime market and the 25 stocks with the highest market capitalization (based on the free float). Should the situation arise that more than 20 companies meet both criteria, the ranking by trading volume serves as the basis as to which stocks are admitted or should remain in the ATX. Basically, a total of 20 stocks are included in the ATX.

For the procedure applied in the bi-annual review of the composition of the other Austrian indices please refer to the Rules for the Austrian Indices of the Vienna Stock Exchange.

CEE & CIS indices

The index committee decides on changes in the index composition (inclusions and exclusions) on the basis of the index rules. Index members are selected according to their turnover and free-float capitalization rank in a respective index watchlist. In order to draw up the watchlist of an index all eligible companies in the respective index universe are ranked according to their turnover and free-float capitalization. For an index only those companies are selected, which fulfil a certain minimum rank by means of turnover and free-float capitalization – this rule will be reffered to as the TO/Cap Rule.

Further information can be found in the Rules for CEE & CIS indices of the Vienna Stock Exchange.

Further information on index changes:

Index adjustments

ATX watchlist

Index reviews

Comittee dates

Comittee members ATX

Comittee members CEE & CIS

Comittee decisions