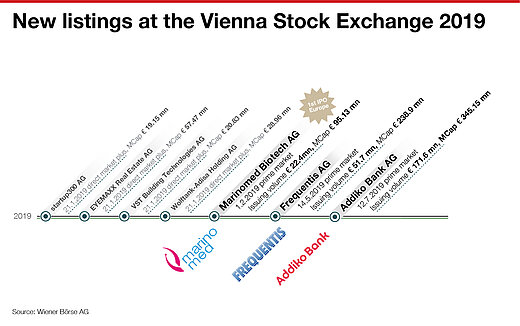

- Three new listings on prime market 2019: Frequentis, Marinomed Biotech and Addiko Bank

- More choice for investors: Record level of equities & bond listings

- Politics demanded: Tax incentives needed to make investing more attractive for retail clients

- Average monthly turnover of EUR 5.2 bn well above five-year average

(Vienna) The Austrian capital market will record as many stock market debuts in 2019 as it last did in 2007. In the prime market segment, the Vienna Stock Exchange has welcomed new companies every quarter: Marinomed Biotech (February), Frequentis (May) and Addiko Bank (July). Four new companies selected the newly established junior segment direct market plus for a stock market listing. In addition to the 655 blue chips tradeable on the international segment global market, another one will be added on Friday, 4 October: Nutella glass manufacturer Verallia SA can be traded in Vienna after its IPO in Paris. A total of 759 equities are now tradable on the Vienna Stock Exchange.

"Never before have we been offering a broader and more exciting product range to investors. The field has been prepared, but only those who sow can reap. Currently, low interest rates make saving impossible. As a compensation, investing should be made easier for the Austrians. Long-term investors should be able to invest their already taxed earned income tax-free in shares", says Christoph Boschan, CEO of the Vienna Stock Exchange and its holding company, and advocates the reintroduction of the withholding tax exemption with a retention period of more than one year. While owners of savings books are losing value in real terms, shareholders of ATX companies have profited this year by a total of EUR 3.2 bn in dividends distributed. The dividend yield is currently an impressive 3.8%.

Bond listings develop dynamically

The Vienna Stock Exchange is heading for a record number of corporate bonds in 2019. This year, 80 new corporate bonds with a volume of almost EUR 13.3 bn have already been listed. With AS Roma (EUR 275 mn) and Russian Railways (EUR 212 mn), renowned international companies were acquired. The newest Green Bond additions include the RBI benchmark bond (EUR 750 mn). The OeKB Sustainability Bond will also be added to the quotation list in the next few days. A total of 3,625 bonds are currently tradable on the Vienna Stock Exchange, also a high.

Monthly turnover stable above 5-year average

In a stock market environment challenged by Brexit and trade disputes, equity trading volume is falling between 9% and 20% across Europe. At the end of the third quarter, equity trading volume on the Vienna Stock Exchange stood at EUR 47.03 bn. This corresponds to a decline of 9.8% compared to the same period of the previous year (EUR 52.12 bn). The average monthly turnover in 2019 amounts to EUR 5.22 bn and is thus stable above the 5-year-average (2014-2018 Q1 Q3: EUR 5 bn).

With its initiative for trading on Austrian holidays, the Vienna Stock Exchange actively counteracted further declines in turnover. 2019 the Vienna Stock Exchange opened its market on four Austrian public holidays. With 84% of trading volumes originating abroad, this was an important step. This offer has been well received by international market participants. The turnover on Assumption Day (15 August 2019) corresponded to that of a regular trading day. On the same day, the Vienna Stock Exchange recorded the highest number of system requests (8,559,313 transactions). Ludwig Nießen, COO & CTO of the Vienna Stock Exchange: "We are constantly upgrading our infrastructure to always be one step ahead of the increasing transactions volumes. We are excellently positioned as an infrastructure provider".

Statistics: ATX, Most traded equities, top performers

Including dividends, the ATX shows a return of +13.82% (+9.64% excluding dividends) year-to-date. With a stock price increase of 45.12% since the beginning of the year, S Immo AG is the top performer on the prime market, followed by Warimpex Finanz- und Beteiligungs AG (+43.00%) and Verbund AG (+34.80%). Newcomer Marinomed Biotech AG (+33.33%) ranked fourth and OMV AG (+28.73%) fifth. The market capitalization of all domestic companies listed on the Vienna Stock Exchange rose to EUR 114.5 bn as of 30 September 2019.

The most actively traded Austrian stocks were Erste Group Bank AG with EUR 9.33 bn turnover, followed by OMV AG with EUR 6.05 bn and voestalpine AG with EUR 5.64 bn. Raiffeisen Bank International AG (EUR 4.21 bn) and Andritz AG (EUR 3.45 bn) ranked fourth and fifth respectively.

Details on individual market segments, indices or securities can be found in our <link 511 - internal-link "Opens internal link in current window">web statistics</link>. For a European stock exchange comparison, take a look at the statistics of the Federation of European Securities Exchanges (FESE).

About the Vienna Stock Exchange

The Vienna Stock Exchange is the only securities exchange in Austria. It features a modern infrastructure and supplies market data and relevant information. It offers Austrian companies maximum visibility, high liquidity and utmost transparency. Investors can rely on the smooth and efficient execution of exchange trades. The Vienna Stock Exchange operates a central market datafeed for Central and Eastern Europe (CEE) and is well established as an expert for the calculation of indices with a reference to the region. Wiener Börse AG, together with its holding company, CEESEG, cooperates with over ten exchanges in CEE and is globally recognized for this unique know-how.

Exclusion of Liability

This press release may contain certain forward-looking statements and forecasts that are based on assumptions current made at the time of publication of this press release. We do not assume any liability for these forward-looking statements materializing. Furthermore, we would like to explicitly point out that this press release cannot serve as a basis for investment decisions and may not be construed as a solicitation to buy or a recommendation to invest by Wiener Börse AG. No liability is assumed for the information given in this press release.