- Frequentis and Marinomed new in the prime segment

- Trading volumes decline throughout Europe, Vienna Stock Exchange performs comparatively well

- "Third Market" renamed "Vienna MTF" as of July

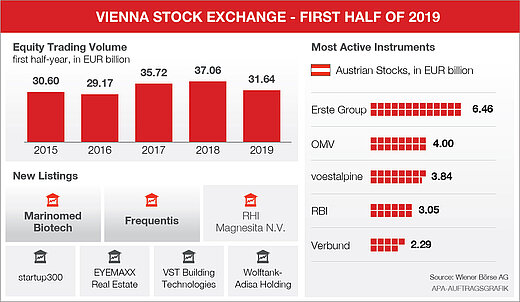

(Vienna) In the first half of 2019, the Vienna Stock Exchange saw the strongest inflow of domestic companies in the last decade. Marinomed kicks off the year with the first Initial Public Offering (IPO) throughout Europe. The biotech company is listed in the prime market segment, as is the security system provider Frequentis following the IPO in May. In the new direct market plus segment launched this year, four new companies are taking advantage of the opportunity to address new shareholders with a listing. The standard market welcomes back RHI Magnesita. The global market and bond listings were also strongly expanded. Out of the 337 new bond listings, 189 were issued by Austrian and 148 by international companies.

"The Austrian IPO engine is roaring, despite a difficult European environment. Currently, further companies are in the process of getting ready for the stock market. PORR and Wienerberger have been building on the stock market for 150 years. This demonstrates the importance of equity capital. As an infrastructure provider, we offer the best market quality for trading in Austrian stocks to domestic and international investors," says Christoph Boschan, CEO of the Vienna Stock Exchange and its holding company.

In a globally uncertain first half of 2019, the equity trading volume on the Vienna Stock Exchange was EUR 31.64 bn, a decline of 14.6% compared to the same period of the previous year (HY1 2018: EUR 37.06 bn). European stock exchanges recorded declines of between 10 and 30% in the first half of the year. At EUR 5.27 billion, however, the average monthly turnover was stable above the five-year average of EUR 5 billion. On important international dates, such as the end of the quarter, the trading volume tripled. On the two strongest trading days in the first half of 2019, 15 March and 21 June, a volume of just under EUR 1 billion each was traded. New initiatives, such as trading on public holidays and the expansion of the international segment global market, generate additional volume. In the global market, the Vienna Stock Exchange has so far recorded well over one billion Euros turnover in 2019 (EUR 1.18 bn). The newly introduced opportunity to trade on selected Austrian holidays is finding global demand. For the first time, EUR 200 million were traded on Corpus Christi, i.e. three quarters of an average trading day. More than 85% of the equity turnover on the Vienna Stock Exchange originates from international trading participants.

"Vienna MTF" replaces "Third Market"

The reorganisation of the market segmentation – the introduction of the direct market and the direct markt plus at the beginning of the year – has been the occasion to bring the rules and regulations in line with international language usage. At the Vienna Stock Exchange, two markets are the basis for all listings. The EU regulated market in Austria is called "Amtlicher Handel" or "Official Market" (prime market, standard market). The exchange regulated market, previously known as the "Third Market", was renamed the “Vienna MTF”. This name change does not entail any alterations to the content of the rules and regulations.

Statistics: ATX, most traded shares, top performers

Including dividends, the Austrian leading index ATX shows a return of +12.17% (+8.45% excluding dividends) in the first half of the year. The ATX companies announced record dividends of over EUR 3.2 billion. With a price increase of 34% since the beginning of the year, Warimpex Finanz- und Beteiligungs AG is the largest price gainer on the prime market, followed by S Immo AG (+30.95%) and Semperit AG (+30.72%). The market capitalisation of domestic companies listed on the Vienna Stock Exchange was EUR 111.96 billion as of 30 June 2019.

The Austrian share with the highest turnover in the first half of 2019 was Erste Group Bank AG with EUR 6.46 billion, ahead of OMV AG with EUR 4 billion and voestalpine AG with EUR 3.84 billion. Raiffeisen Bank International AG (EUR 3.05 billion) and Verbund AG (EUR 2.29 billion) ranked fourth and fifth.

Details on individual market segments, indices or securities can be found in our web statistics. For a European stock exchange comparison, take a look at the statistics of the Federation of European Securities Exchanges (FESE).

Download infographics

About the Vienna Stock Exchange

The Vienna Stock Exchange is the only securities exchange in Austria. It features a modern infrastructure and supplies market data and relevant information. It offers Austrian companies maximum visibility, high liquidity and utmost transparency. Investors can rely on the smooth and efficient execution of exchange trades. The Vienna Stock Exchange operates a central market datafeed for Central and Eastern Europe (CEE) and is well established as an expert for the calculation of indices with a reference to the region. Wiener Börse AG, together with its holding company, CEESEG, cooperates with over ten exchanges in CEE and is globally recognized for this unique know-how.

Exclusion of Liability

This press release may contain certain forward-looking statements and forecasts that are based on assumptions current made at the time of publication of this press release. We do not assume any liability for these forward-looking statements materializing. Furthermore, we would like to explicitly point out that this press release cannot serve as a basis for investment decisions and may not be construed as a solicitation to buy or a recommendation to invest by Wiener Börse AG. No liability is assumed for the information given in this press release.