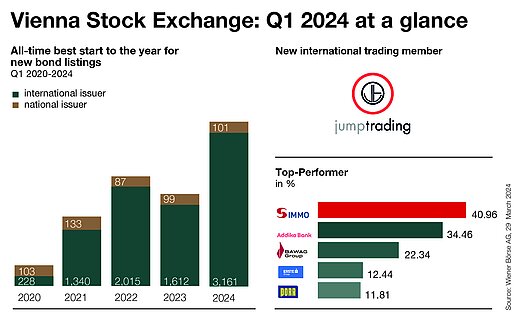

(Vienna) High interest rates, the ongoing war in Ukraine and persistently high inflation: trading activity on the Vienna Stock Exchange in the first quarter of 2024 – as on comparable European markets – was characterised by the unchanged difficult conditions. Share turnover totalled EUR 14.3 billion in the first three months. Bond listings, on the other hand, remained at a record level, with 3,000 new listings, the best start to a year in historical terms. Securities ownership in Austria is also developing positively, as the latest “Aktienbarometer” shows. With Jump Trading B.V., a new trading member was connected to the Vienna Stock Exchange. This means that a total of 69 members – 21 Austrian and 48 international banks and investment firms – are currently authorised to trade on the Vienna Stock Exchange.

"Trading volumes declined across the EU, with the exception of Italy and Germany. As an exchange company our successful business diversification enables us to compensate for subdued trading activity", explains Christoph Boschan, CEO of the Vienna Stock Exchange and adds: "Austria remains a highly interesting market with its attractive dividend yields of 6% on average and a very moderate valuation."

Share turnover totalling EUR 14.3 billion was recorded for the first quarter. The three strongest trading days year-to-date were 15 March (EUR 812.8 million), 29 February (EUR 517.8 million) and 31 January (EUR 342 million). The shares with the highest turnover as of 28 March were Erste Group Bank AG (EUR 2.44 billion), OMV AG (EUR 1.97 billion) and Verbund AG (EUR 1.41 billion).

Increasing securities ownership in Austria

Austrian shares are certainly very popular among domestic security holders, as the Aktienbarometer 2024 – a study by Aktienforum, the Federation of Austrian Industries and the Vienna Stock Exchange – shows. Almost three quarters (72%) of people who invest in securities also hold stocks in Austrian companies. In general, the current Aktienbarometer shows a positive trend: According to it, more than one in four people (27%) in Austria already invest in stocks, bonds or investment funds and ETFs. The number of Austrian investors has thus risen by two percentage points or 200,000 people compared to the previous year. The study also emphasises the key role of education: a higher level of education correlates strongly with the ownership of securities. Conversely, the perceived lack of sound financial knowledge is the main reason for not investing in securities.

"The positive trend in securities ownership is even more remarkable given the unfavourable economic environment and missing incentives for private pension provision, for example through capital gains tax. Policymakers are lagging behind the growing public need for private pension provision and the reintroduction of a retention period for securities is long overdue. The study also highlights the continuing need for comprehensive financial education. Greater capital market integration of the population is not only important for individual wealth accumulation, but also strengthens our economy and promotes the growth of innovative companies," says Boschan.

Bonds: Record year followed by historically best first quarter

Growth in the bond segment remains strong. After the Vienna Stock Exchange recorded more new listings than ever before in 2023, the first quarter seamlessly followed on from the record year. More than 3,000 new listings on the exchange-regulated Vienna MTF in the first three months represent an all-time high. The Vienna Stock Exchange serves a total of 900 active bond issuers from 37 countries. The first quarter also brought a significant change for Austrian government bonds. These have been tradable all day on the Vienna Stock Exchange since the beginning of March. As market makers, Erste Group Bank AG and Raiffeisen Bank International AG ensure continuous liquidity and high price quality, which benefits private investors in particular.

Sideways movement in the national index

After the ATX TR gained 15.44% in the past year (ATX excluding dividends: 9.87%), the market moved sideways in the first quarter. Year-to-date, the ATX TR rose by 3.35% and stood at 7,871.14 points on 28 March (ATX: 2.94%, 3,535.79 points). The comparatively high inflation in Austria and ongoing uncertainties due to the war in Ukraine are putting disproportionate pressure on Austria's leading companies with their strong CEE network and therefore on the ATX. In addition, ATX stocks are currently valued at historically low levels with a price/earnings ratio of around 7.5. The traditionally high dividend yields remain unaffected by the current situation: The forecast average dividend yield in the ATX for 2024 is around 6%. Following share price gains, S IMMO AG (40.96%), Addiko Bank AG (34.46%) and BAWAG Group AG (22.34%) were the top performers in the ATX Prime since the beginning of the year up to 28 March. The market capitalisation of all companies listed in Vienna amounted to EUR 127.5 billion at this time.

For enquiries, please contact:

About the Vienna Stock Exchange

As the central infrastructure provider in the region, Wiener Börse AG opens doors to global markets. It operates the stock exchanges in Vienna and Prague. Listed companies benefit from maximum liquidity there, and as the market leader it offers investors fast and inexpensive trading. Wiener Börse collects and distributes price data and calculates the most important indices for a dozen markets in the region. Thanks to its unique know-how, the national exchanges in Budapest, Ljubljana and Zagreb also rely on the IT services of the Vienna Stock Exchange. In addition, it is involved in other energy exchanges and clearing houses in the region.

Disclaimer

This press release may contain certain forward-looking statements and projections based on assumptions current at the date of this press release. We assume no liability whatsoever that these forward-looking statements will occur. Furthermore, we expressly point out that this press release does not serve as a basis for an investment decision and constitutes neither an invitation to buy nor an investment recommendation by Wiener Börse AG. The information in this press release is provided without guarantee.