- Equity turnover on the Vienna Stock Exchange with a plus of 23.86% in HY1/2020

- 2020 strong year for bond listings

- Rapid implementation of the government programme supports crisis management

- Financial education high on the agenda during the Corona crisis

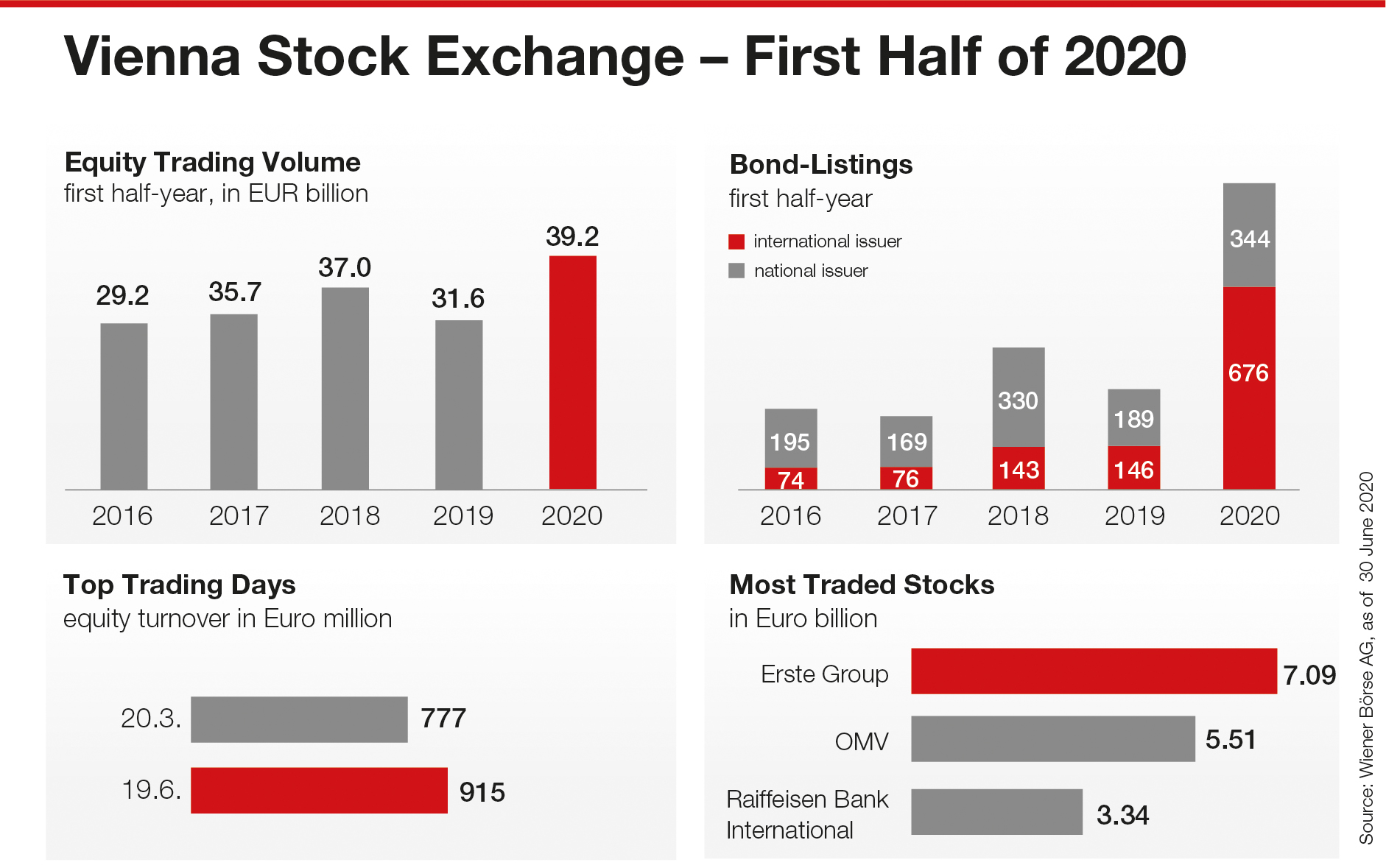

(Vienna) Equity turnover on Vienna Stock Exchange developed positively in the first half of 2020: at EUR 39.18 bn, it is more than one-fifth higher compared to the previous year. At the same time, Vienna Stock Exchange expanded its market share. The national exchange operator has attracted 1,020 new bond listings since the beginning of the year. Thus, the number of new bonds listed more than tripled compared to the first half of 2019. With 676 new bonds, a large amount came from international companies. These include Banco Bilbao Vizcaya Argentina, the second largest bank in Spain and one of the 50 largest banks worldwide. Since March, it has been the largest bond issuer in Vienna.

"The infrastructure of Vienna Stock Exchange is an optimal platform for domestic companies. It will be crucial for future growth that more Austrian companies use the domestic stock exchange. While loans are currently the main focus, the hour of equity will soon strike. In the long term, the only way out of the crisis will be through recapitalization," says Christoph Boschan, CEO of Vienna Stock Exchange. "In order for Austria's economy to recover more swiftly, we need to return to the path taken by the government before Corona."

Pandemic causes volatile stock markets

In the first half of 2020, a period of global uncertainty, equity turnover on Vienna Stock Exchange amounted to EUR 39.18 bn, an increase of 23.86% compared to the previous year (HY1 2019: EUR 31.64 bn). With EUR 6.53 bn, the average monthly turnover in Vienna is at its highest level since 2010. The most active trading days in 2020 were the Triple Witching days on 20 March (EUR 777 m) and 19 June (EUR 915 m). The most actively traded Austrian stocks were Erste Group Bank AG with EUR 7.09 bn, ahead of OMV AG with EUR 5.51 bn and Raiffeisen Bank International AG with EUR 3.34 bn. In fourth and fifth place followed voestalpine AG (EUR 3.12 bn) and Verbund AG (EUR 2.46 bn).

New initiatives of the Vienna Stock Exchange, such as trading on public holidays and the expansion of the international segment "global market" provided additional volume. In the global market, Vienna Stock Exchange has recorded turnover of nearly EUR 1.73 bn in 2020 to date, compared to EUR 1.79 bn in the full year 2019. Holiday trading on 6 January (EUR 138 m; during the previous year, 6 January fell on a weekend), 21 May (EUR 185 m, +40 m vs 2019) and 11 June (EUR 288 m, +87 m vs 2019) brought an additional EUR 611 m. Over 85% of the share turnover on the Vienna Stock Exchange comes from international trading participants.

High demand for financial education during the crisis

In times of crisis, the need for information increases. Vienna Stock Exchange has been committed to providing financial education for beginners and professionals since 1991. The seminars offered by the Vienna Stock Exchange Academy, a cooperation with the WIFI Management Forum of WIFI Vienna, were converted to webinars at the beginning of April. Around 1,100 participants took advantage of the adapted and free educational offer. From September until the end of the year, 39 courses will again be offered as attendance seminars.

The information offered on the website wienerboerse.at also registered record visits and a high average viewing time of six minutes in March and April. In addition to the share price information, which accounts for the majority of page impressions, company updates were also in demand. With information on protective mechanisms in stock exchange trading, links to virtual general meetings, as well as an open letter to investors in which the voices of the leading domestic companies were bundled, Vienna Stock Exchange focused on transparency and cohesion.

"In times like these, our motto 'Education is the best protection for investors' applies all the more. In recent weeks, the Vienna Stock Exchange Academy has focused increasingly on webinars and enabled all interested parties to take advantage of our wide range of offerings also from home," says CEO Boschan, pleased with the positive response. "Despite the volatile environment, there is no way around shares. Simple investment principles minimise fluctuations and free investors from the need to choose the right time and make the right stock selection. A broad diversification and regular saving substantially increase security," adds Boschan.

Corona concerns weigh on stock markets worldwide

The domestic leading index ATX (including dividends) fell by 29.14% in the course of 2020. The all-year high was on 2 January at 6,208.00 points, the all-year low on 18 March at 3,135.05 points. Since the all-year low and the joint appeal by listed companies and key stakeholders to investors not to turn their backs on Austrian stocks, the Austrian national index has recorded an increase of +38.47%. The market capitalization of all Austrian companies listed on the Vienna Stock Exchange was EUR 90.04 bn as of 30 June 2020.

Details on individual market segments, indices or securities can be found in our web statistics.

Download infographic: Vienna Stock Exchange HY1/2020 (jpg-file 615 KB)

For further information, please contact:

About Wiener Boerse AG

As the main provider of market infrastructure in the region, Wiener Boerse AG is the gate to global markets. Operating the stock exchanges in Vienna and Prague, the group offers state-of-the-art systems, information and IT services. Listed companies receive maximum liquidity and investors benefit from fast and cost-effective trading by the market leader. Wiener Boerse AG also collects and distributes stock market data and calculates the most important indices of the region. Because of this unique know-how the national stock exchanges in Budapest, Zagreb and Ljubljana trust its IT services. Additionally, the group holds stakes in energy exchanges and clearing houses.

Exclusion of Liability

This press release may contain certain forward-looking statements and forecasts that are based on assumptions current made at the time of publication of this press release. We do not assume any liability for these forward-looking statements materializing. Furthermore, we would like to explicitly point out that this press release cannot serve as a basis for investment decisions and may not be construed as a solicitation to buy or a recommendation to invest by Wiener Börse AG. No liability is assumed for the information given in this press release.