- Study: Institutional investors hold more than two thirds of free float of Austrian companies listed on the prime market

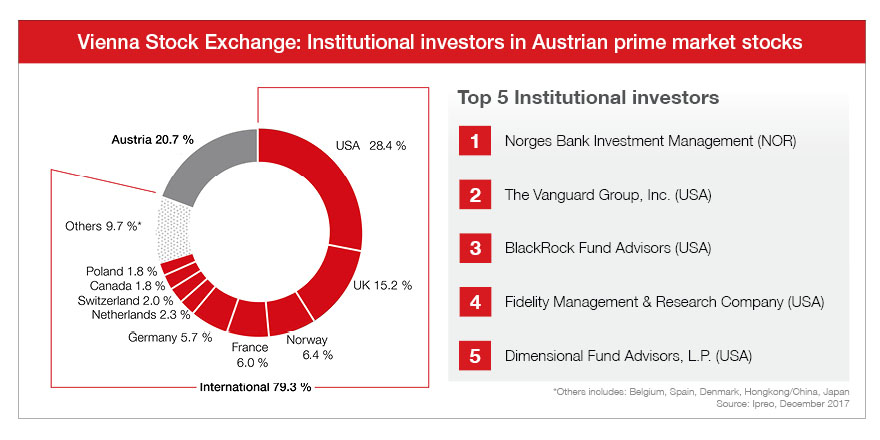

- Geographic distribution: US (28.4%) ahead of Austria (20.7%) and Great Britain (15.2%)

- Top institutional investors: Sovereign fund Norges (NO), Vanguard Group (US) and Black Rock Fund Advisors (US)

- Passive investments continue to gain ground

(Vienna) Institutional investors were the largest group of investors in ATX prime stocks as of year end 2017, with a 69.9% share in the free float corresponding to an absolute value of EUR 39.1 billion, according to the latest IPREO study (pdf-file 525 KB) conducted on behalf of Vienna Stock Exchange. "The study confirms that Austrian stocks continue to retain their appeal for international investors. The Vienna Stock Exchange is the go-to trading venue for investors – and that is because domestic stocks trade most efficiently on our platform. To continue to foster this dominant position, we engage in activities that are helping to increase liquidity over time," said Vienna Stock Exchange CEO Christoph Boschan.

Geographic distribution

With a share of 28.4%, institutional investors from the US are the largest group of professional investors (31 Dec. 2016: 27.7%) and have topped the ranking over the past five years. Austrian institutional investors come in second with 20.7% (31 Dec. 2016: 19.6%), followed by institutionals from the UK with 15.2% (31 Dec. 2016: 13.3%). In total, institutional investors from these three countries manage almost two thirds of the entire free float of Austrian blue chips. In 2017, investors from Belgium, Ireland, Luxembourg, New Zealand and Malta also increased their investments.

"An international profile and being part of a broad global network are essential for a stock exchange to thrive. Over 1,000 traders from 12 European financial centers – but mostly in London - are currently connected to our trading system. With an enlarged sales team and proactive communications, we are working intensely to raise the visibility of the Vienna Stock Exchange as a key hub in the European stock market landscape," explained Boschan.

Top investors in the ATX prime

The Norwegian sovereign fund of Norges Bank once again topped the list of institutional investors in prime market stocks. Second in ranking is US asset manager Vanguard Group and third is US asset manager Black Rock Fund Advisors. In total, five of the top ten institutional investors come from the US, just like in 2016.

1. Norges Bank Investment Management (Norway)

2. The Vanguard Group, Inc. (US)

3. BlackRock Fund Advisors (US)

4. Fidelity Management & Research Company (US)

5. Dimensional Fund Advisors, L.P. (US)

6. Erste Asset Management GmbH (Austria)

7. Erste Sparinvest Kapitalanlage GmbH (Austria)

8. J.P. Morgan Asset Management (UK)

9. Raiffeisen Kapitalanlagegesellschaft mbH (Austria)

10. T. Rowe Price Associates, Inc. (US)

Passive investments continue to gain ground

The global trend toward passively managed investments through ETFs was also confirmed by the findings of the study. The share of institutional investors that invest through an index increased compared to 2016 and stood at 16.5% in 2017. As in the past, value and growth investing continued to dominate in 2017. At the end of 2017, growth investing accounted for 35.5% of investments in the ATX prime, and value investing for 30.8%.

Download info graphic (jpg-file 170 KB)

For further information, please contact:

About the Vienna Stock Exchange

The Vienna Stock Exchange is the only securities exchange in Austria. It features a modern infrastructure and supplies market data and relevant information. It offers Austrian companies maximum visibility, high liquidity and utmost transparency. Investors can rely on the smooth and efficient execution of exchange trades. The Vienna Stock Exchange operates a central market datafeed for Central and Eastern Europe (CEE) and is well established as an expert for the calculation of indices with a reference to the region. Wiener Börse AG, together with its holding company, CEESEG, cooperates with over ten exchanges in CEE and is globally recognized for this unique know-how.

Exclusion of Liability

This press release may contain certain forward-looking statements and forecasts that are based on assumptions current made at the time of publication of this press release. We do not assume any liability for these forward-looking statements materializing. Furthermore, we would like to explicitly point out that this press release cannot serve as a basis for investment decisions and may not be construed as a solicitation to buy or a recommendation to invest by Wiener Börse AG. No liability is assumed for the information given in this press release.