- Vienna Stock Exchange ranks 11th by turnover among 22 stock exchanges

- International investors account for over 85% of trading volume on VSE

- global market is second-liveliest segment after prime market

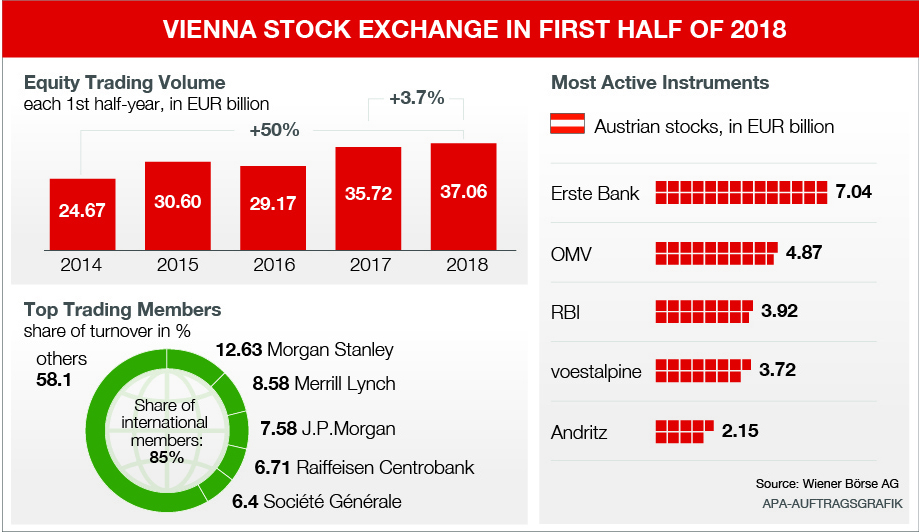

(Vienna) In the first half of 2018, the Vienna Stock Exchange achieved an equity trading volume of EUR 37.06 billion. A particularly robust first quarter increased trading and turnover by 3.7% yoy (HY1 2017: EUR 35.72 billion). In a five-year comparison, turnover was 50% higher. At an average monthly trading volume of EUR 6.18 billion, Vienna currently ranks 11th in a ranking of 22 European stock exchanges. The international segment global market has developed into the second-largest stock market segment, right behind the leading prime market. At EUR 157.27 million, June was the most dynamic trading months since the segment was launched approximately one year ago. In total, more than EUR 1 billion was traded.

"We have been working hard to improve the quality of the market and strengthen the position of the Vienna Stock Exchange as an international hub," said Christoph Boschan, CEO of Wiener Börse AG. "One of our priorities in the first half-year was raising Vienna Stock Exchange's international profile, as the European exchange community met here several times to discuss the outlook for the industry. This shows that our pro-active efforts are bearing fruit - companies, investors and Vienna as a business location benefit from this."

Most active stocks and trading members

The most active Austrian stock was Erste Group Bank AG with EUR 7.04 billion, ahead of OMV AG with EUR 4.87 billion and Raiffeisen Bank International AG with EUR 3.92 billion. In fourth and fifth place were voestalpine AG (EUR 3.72 billion) and Andritz AG (EUR 2.15 billion). The most frequently-traded stock on the global market was RHI Magnesita N.V. with EUR 244.71 million. On the ETF segment, LYXOR ETF EURO STOXX 50 was the most active stock (EUR 9.22 million). The Oberbank bond (AT000B112958) with a maturity of 2015-2020 was the most active corporate bond (EUR 10.96 million).

Apart from the two large Austrian trading members, international trading participants accounted for over 85% of trading volume on the Vienna Stock Exchange. Morgan Stanley ranked first with a share in trading in HY1 2018 of 12.63% ahead of Merrill Lynch (8.58%) and J.P. Morgan (7.58%). Raiffeisen Centrobank (6.71%) and Société Générale (6.4%) came in fourth and fifth in the ranking.

"In preparation for Brexit, we developed a specific support package for affected trading members. The on-going modernization of our infrastructure enables us to guarantee a high degree of stability and system performance for our customers. We also share this know-how with our partner exchanges in the region. Our well-established network in Eastern Europe puts the Vienna Stock Exchange at the heart of the stock exchange community in Central and Eastern Europe – not only geographically," said Ludwig Nießen, COO & CTO of Wiener Börse AG.

Statistics: Price movements, winners & losers in the leading ATX index

In the first half-year 2018, the ATX moved in line with other established European indices and was down by 4.8% (-2.47% incl. dividends). The leading Austrian index stood at 3,255.96 points on 29 June 2018 (all-year high on 23 January 2018: 3,688.78 points; all-year low on 25 June 2018: 3,227.56 points). On the prime market, several stocks out-performed the Austrian stock barometer ATX: at a price gain of 37.50% since the start of the year, Verbund AG was the best performer on the prime market, followed by Valneva SE (32.73%), Schoeller-Bleckmann AG (21.53%), Wolford AG (18.74%) and CA Immobilien Anlagen AG (10.60%). The market capitalization of all domestic companies listed on the Vienna Stock Exchange was EUR 126.1 billion on 29 June 2018.

Details on the individual market segments, indices and securities are available on our web statistics page. A comparison of European stock exchanges is available in the statistics published by the Federation of European Securities Exchanges (FESE).

Download info graphic (jpg-file 930 KB)

For further information, please contact:

About the Vienna Stock Exchange

The Vienna Stock Exchange is the only securities exchange in Austria. It features a modern infrastructure and supplies market data and relevant information. It offers Austrian companies maximum visibility, high liquidity and utmost transparency. Investors can rely on the smooth and efficient execution of exchange trades. The Vienna Stock Exchange operates a central market datafeed for Central and Eastern Europe (CEE) and is well established as an expert for the calculation of indices with a reference to the region. Wiener Börse AG, together with its holding company, CEESEG, cooperates with over ten exchanges in CEE and is globally recognized for this unique know-how.

Exclusion of Liability

This press release may contain certain forward-looking statements and forecasts that are based on assumptions current made at the time of publication of this press release. We do not assume any liability for these forward-looking statements materializing. Furthermore, we would like to explicitly point out that this press release cannot serve as a basis for investment decisions and may not be construed as a solicitation to buy or a recommendation to invest by Wiener Börse AG. No liability is assumed for the information given in this press release.