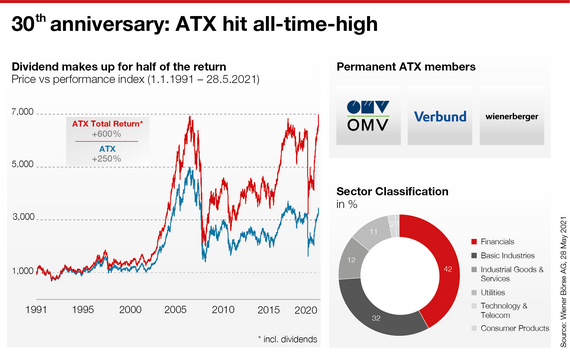

(Vienna) In the 250th jubilee year of the Vienna Stock Exchange, the Austrian national index ATX also celebrates a special anniversary. On 13 May, the birthday of the founder of the Vienna Stock Exchange Maria Theresa, the Austrian stock exchange barometer was published for the first time. At the close of trading on 13 May 1991, a score of 1,192.95 flickered across the TV screens. 30 years later, the Austrian national index showed 6,688,08 points including dividends on 10 May (excl. dividends: 3,376,39 points). Thus, it is close to its all-time high of 6,727,44 points (9 July 2007). Investors who have consistently invested in ATX shares since the beginning of January 1991 can today look at a total performance of +678% (annual average return: 6.51%). The ATX tracks the performance of the 20 largest and most actively traded stocks on the Vienna Stock Exchange.

"Happy Birthday ATX! With its average return of 6.51% the Austrian stock market benchmark lies in the strong midfield in a European comparison. This goes in line with the geographic location auf Austria, which is often seen as the bridge between eastern and western Europe. The index ATX Total Return is the correct benchmark for performance comparisons with other markets. Austrian stocks are dividend kings. Dividends make make up for half of the ATX return.", says Christoph Boschan, CEO of the Vienna Stock Exchange. A newly designed explanatory video as well as an infographic show the difference visually.

30 years of the ATX: Cyclical stocks as the driving force

A set of rules in line with international standards determines which companies are represented in the ATX. The Index Committee reviews the composition twice a year as well as the calculation factors of the ATX four times a year. Since the start, three companies have been represented in the ATX without interruption: OMV AG, Verbund AG und Wienerberger AG. The focus in the sector mix lies on the financial industry (42%), basic industry (32%) and industrial goods and services (12%). As a result, the national index moves cyclically. If the economy is booming, it rises higher, if the market is pessimistic, it tends to fall.

The ATX family comprises about 40 indices. In addition to the price and performance variant, the benchmarks offered also include e.g. leverage, sector and short indices. Investors have the opportunity to invest in over 5,500 ATX-based certificates and warrants as well as two ETFs (iShares or xTrackers). Today, the index portfolio of the Vienna Stock Exchange extends far beyond Austria. Of the approximately 150 indices offered, the majority of the benchmarks track the region of Central and Eastern Europe and Russia.

More information:

Explanatory video on the ATX

Download info graphic (png-file 70 KB)

For further information, please contact:

Julia Resch

Head of Corporate Communications & Marketing, Spokesperson

About the Vienna Stock Exchange

As the main provider of market infrastructure in the region, Wiener Börse AG is the gate to global markets. Operating the stock exchanges in Vienna and Prague, the group offers state-of-the-art systems, information and IT services. Listed companies receive maximum liquidity and investors benefit from fast and cost-effective trading by the market leader. Wiener Börse AG also collects and distributes stock market data and calculates the most important indices of the region. Because of this unique know-how the national stock exchanges in Budapest, Ljubljana and Zagreb trust its IT services. Additionally, the group holds stakes in energy exchanges and clearing houses.

Exclusion of Liability

This press release may contain certain forward-looking statements and forecasts that are based on assumptions current made at the time of publication of this press release. We do not assume any liability for these forward-looking statements materializing. Furthermore, we would like to explicitly point out that this press release cannot serve as a basis for investment decisions and may not be construed as a solicitation to buy or a recommendation to invest by Wiener Börse AG. No liability is assumed for the information given in this press release.