- ATX Total Return (incl. dividends) moves towards all-time high

- Equity turnover stable at high level in Q1 2021

- Two new listings in direct market plus, one new listing in direct market

- Bonds: listing activity continues to rise strongly

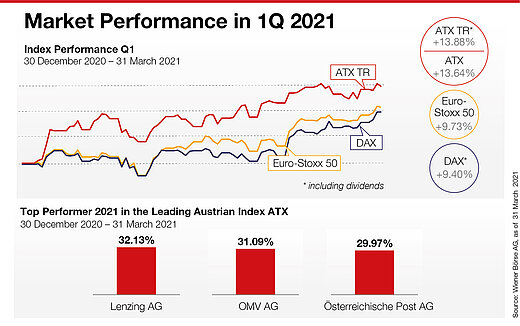

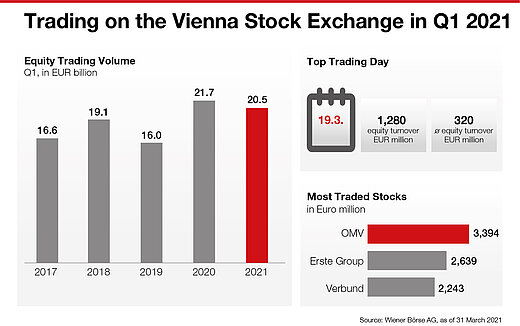

(Vienna) The Austrian stock market continues to pick up speed in the first quarter of 2021. The Austrian national index ATX ranks among the top indices in a global comparison (ATX TR: +13.88% DAX: +9.40%, Eurostoxx 50: +9.73%, S&P 500: +6.45%). The rally is accompanied by strong equity turnover (January-March 2021: EUR 20.5 billion). In the direct market plus, the Vienna Stock Exchange welcomed two companies (beaconsmind AG, XB Systems AG), Extrafin S.p.A. is new to the direct market. With more than 1,400 new listings, Q1 2021 was the historically best first quarter ever for bonds. This growth is spurred by international serial issuers on the Vienna MTF. Austrian companies are currently focusing on green bonds (new issues by S Immo AG, Vienna Insurance Group AG, Verbund AG).

"One year after the Corona slump, the crisis resistance of Austrian equities is priced in again. Austrian stocks convince investors with established business models, strong R&D ratios and a reliable dividend strategy. The ATX Total Return shows how strongly the dividend factor contributes to the overall return. Since the start of the index, half of the ATX performance has resulted from dividend payments. Perseverance pays off," says Christoph Boschan, CEO of the Vienna Stock Exchange.

ATX doubles within one year

In the first quarter, the domestic ATX Total Return including dividends increased by 13.88% to 6,225.10 points (excl. dividends 3,159.77 points, 13.64%). On a year-to-date basis, it is clearly ahead of the German DAX, which also includes dividends. Since the beginning of January, the ATX Total Return has climbed steadily. It reached its year-high of 6.250.93 points on 30 March, thus coming closer to its all-time high (6,727.44 points, 9 July 2007). 19 out of 20 ATX stocks posted gains so far this year. Among the top performers in the ATX were Lenzing AG (+32.13%), OMV AG (+31.09%) and Österreichische Post AG (+29.97%). On the prime market, Semperit AG (+56.17%), Addiko Bank AG (+45.14%) and Polytec (+42.74%) were the top performers. The market capitalization of domestic companies listed in Vienna rose to EUR 119.43 billion as of 31 March 2021.

Equity turnover: March brings strongest trading day since September 2008

In the first quarter, trading volumes on the Vienna Stock Exchange maintained its high level. At EUR 20.5 billion, trading participants generated almost as much turnover as they did in the first quarter of 2020 (EUR 21.7 billion), which was dominated by crisis sentiment. The triple witching day was particularly strong this quarter. Friday, 19 March was the busiest trading day in Vienna since September 2008, with trading participants generating EUR 1.3 billion, four times more turnover than on an average trading day (EUR 320 million). The most actively traded Austrian stocks this year 2021 so far were OMV AG (EUR 3.39 billion), Erste Group Bank AG (EUR 2.64 billion), Verbund AG (EUR 2.24 billion), voestalpine AG (EUR 1.54 billion) and Raiffeisen Bank International AG (EUR 1.08 billion).

"New investors have discovered the stock market this year. Through a broad portfolio and regular investments, everyone can benefit financially from the advancements of our modern society. The stock market secures prosperity for our children and provides capital for pioneers. Austria has strong potential to boost its domestic capital market instead of just administering it. This can make all the difference in the post-Corona era," says Boschan.

250 Years Wiener Boerse – Future Forum

The upcoming expert talk next week will be dedicated to the topic "Innovation made in Austria - financing industry of the future". In its 250th anniversary year, the Vienna Stock Exchange hosts regular panel discussions with experts looking at future and past developments. At the beginning of March, risk researcher Didier Sornette and chief analyst Monika Rosen discussed what stock market prices are currently anticipating. Journalist Anneliese Rohrer contrasts the development of stock markets in the German-speaking and Anglo-American regions with historian Clemens Jobst and Christoph Boschan.

Download infographics:

Trading on the Vienna Stock Exchange in Q1 2021 (jpg-file 200 KB)

Market development in Q1 2021 (jpg-file 90 KB)

For further information, please contact:

Julia Resch

Head of Corporate Communications & Marketing, Spokesperson

About the Vienna Stock Exchange

As the main provider of market infrastructure in the region, Wiener Börse AG is the gate to global markets. Operating the stock exchanges in Vienna and Prague, the group offers state-of-the-art systems, information and IT services. Listed companies receive maximum liquidity and investors benefit from fast and cost-effective trading by the market leader. Wiener Börse AG also collects and distributes stock market data and calculates the most important indices of the region. Because of this unique know-how the national stock exchanges in Budapest, Ljubljana and Zagreb trust its IT services. Additionally, the group holds stakes in energy exchanges and clearing houses.

Exclusion of Liability

This press release may contain certain forward-looking statements and forecasts that are based on assumptions current made at the time of publication of this press release. We do not assume any liability for these forward-looking statements materializing. Furthermore, we would like to explicitly point out that this press release cannot serve as a basis for investment decisions and may not be construed as a solicitation to buy or a recommendation to invest by Wiener Börse AG. No liability is assumed for the information given in this press release.