(Vienna) A changing inflation and interest rate environment, the Russian attack on Ukraine and the ongoing energy crisis weighed on European stock markets in 2022. With a forecast of EUR 72 billion, trading participants on the Vienna Stock Exchange generated roughly the same turnover as in the strong previous year. The primary market was challenging. With Pierer Mobility AG and RHI Magnesita N.V., the prime market grew to 40 companies. In the SME segment, VAS AG from Salzburg made its stock market debut. In the bond segment, Vienna maintained its successful course despite difficult market conditions and thanks to new international customers.

"The Vienna-Prague Stock Exchange Group was able to implement important projects in 2022 and strengthen its position as a Central European exchange operator. Thanks to the diversification of our business areas and strategic planning for the coming years, I see Wiener Börse on a good course," said Christoph Boschan, CEO of Wiener Börse AG. He believes in a promising future for equity financing: "In order to make our economy fit for the future, Europe needs innovation, which can only be financed with equity. Economies with developed capital markets grow stronger and will transform faster."

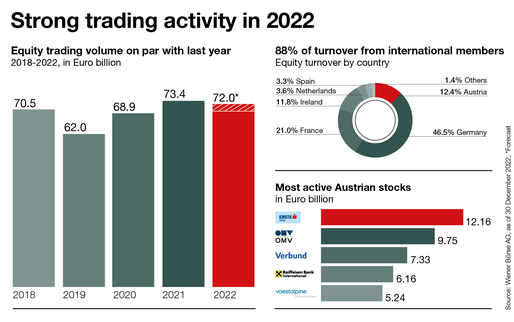

Equity turnover on par with last year

After a strong first quarter marked by high volatility, equity turnover settled at pre-crisis levels by the end of the year. In the course of 2022, trading participants are forecast to generate EUR 72.0 billion in equity turnover (2021 EUR 73.4 billion). The three strongest trading days were 31 May (EUR 1,117 million), 28 February (EUR 911 million) and 18 March (EUR 870 million). On an average trading day, EUR 283 million in turnover was recorded. The year 2022 had 255 trading days, and in 2023 Vienna will trade on 254 days. The official trading calendar is available online.

65 trading participants are active on the Vienna Stock Exchange (44 international, 21 national). At around 88%, the majority of turnover is generated by international trading members. Since September, the international market making house Optiver has also been trading in Vienna. To ensure a continuous dialogue with global investors, the Vienna Stock Exchange is organising six international investor conferences for listed companies in Cologne, London, New York, Paris, Warsaw, and Zurich in 2023.

The most active Austrian stocks in 2022 were Erste Group Bank AG (EUR 12.16 billion), OMV AG (EUR 9.75 billion), Verbund AG (EUR 7.33 billion), Raiffeisen Bank International AG (EUR 6.16 billion) and voestalpine AG (EUR 5.24 billion).

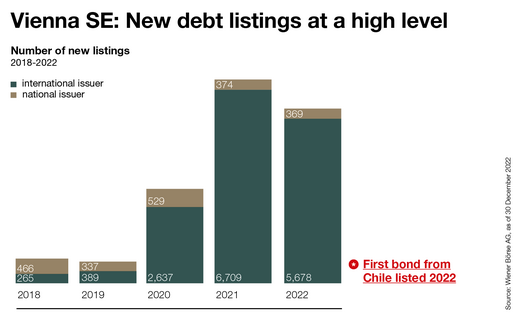

Vienna Stock Exchange one of the most active European debt listing venues

In 2022, the Vienna Stock Exchange established itself as one of the leading addresses for debt listings in Europe. With around 6,050 mostly international listings, the number of new bonds is at a high level, despite the declining trend in new issues on global markets. The sales team was able to increase the number of new international clients by 25% in 2022. Recently, the first bond from Chile (Aguas Andinas S.A.) was listed in Vienna. Currently, more than 800 issuers from 37 countries are among the clients. In total, more than 13,000 bonds with a volume of around EUR 700 billion are listed in Vienna. With the Vienna ESG Segment, a new set of rules for green & social bonds came into force in 2022 that complies with strict industry standards.

Investing in 2022: Patience pays off

Developed stock markets worldwide mostly showed double-digit price declines over the year. The Austrian stock market blends into this picture in 2022. While the Austrian national index ATX TR, including dividends, gained 43.59% in the previous year, it lost 16.04% year-to-date. On 28 December 2022, the ATX TR stood at 6,589.84 points, roughly at the same level as before the pandemic (ATX without dividends -19.12%, 3,122.96 points). Even though the national index tends to fluctuate more than other barometers, it is in line with the European average stock market performance in the long term with an average return of 6%.

In the prime market, some companies defied this year's global downward trend: Schoeller-Bleckmann Oilfield Equipment AG (+85.78%), Flughafen Wien AG (+23.87%), DO&CO AG (+20.65%), ANDRITZ AG (+18.67%) and STRABAG SE (+6.14%) posted significant gains over the course of the year. The market capitalisation of all domestic companies listed in Vienna was EUR 114.73 billion as of 28 December 2022.

"The business models of Austrian companies are proving to be crisis-proof, stable and offer high dividends, which makes them popular with international investors. Austrian shares are a must in any European portfolio. Only those investors who persevere in times of decline will benefit from the returns of the stock market in the long term. The historical average return of the stock market significantly outperforms other asset classes. The state should also reward long-term participation in the markets and offer tax incentives to citizens who make privat provisions," Boschan argues for the reintroduction of a holding period, i.e. an exemption from securities capital gains tax for a holding period of one year or more.

Infographics on stock trading & new bond listings for download

For further information, please contact:

Julia Resch

Head of Corporate Communications & Marketing, Spokesperson

About Wiener Boerse

As the main provider of market infrastructure in the region, Wiener Börse AG is the gate to global markets. Operating the stock exchanges in Vienna and Prague, the group offers state-of-the-art systems, information and IT services. Listed companies receive maximum liquidity and investors benefit from fast and cost-effective trading by the market leader. Wiener Börse AG also collects and distributes stock market data and calculates the most important indices of the region. Because of this unique know-how the national stock exchanges in Budapest, Ljubljana and Zagreb trust its IT services. Additionally, the group holds stakes in energy exchanges and clearing houses.

Exclusion of Liability

This press release may contain certain forward-looking statements and forecasts that are based on assumptions current made at the time of publication of this press release. We do not assume any liability for these forward-looking statements materializing. Furthermore, we would like to explicitly point out that this press release cannot serve as a basis for investment decisions and may not be construed as a solicitation to buy or a recommendation to invest by Wiener Börse AG. No liability is assumed for the information given in this press release.