The primary responsibility of a liquidity provider is to ensure the continuous provision of liquidity within the order book of the trading system.

Liquidity providers on the Wiener Börse undertake to supply binding bid and ask quotes for a security in the Xetra® T7 order book. The quotes must comprise a certain minimum size on both the bid and ask side and be offered within a defined (minimum) time while complying with a maximum permissible spread.

By providing liquidity and offsetting imbalances between bid and ask orders in the order book, liquidity providers contribute to price stabilization, especially in times of volatility. This also increases the likelihood that orders from all investors can be executed.

All trading participants on the Wiener Börse can become liquidity providers by entering into a quotation obligation (= a contract with the Wiener Börse that includes, among other things, the quotation parameters such as the maximum spread) for a security. The Wiener Börse monitors the activities of liquidity providers and incentivizes them when they fulfill their quotation obligations by granting them reduced transaction fees.

Continuous Trading with Auctions

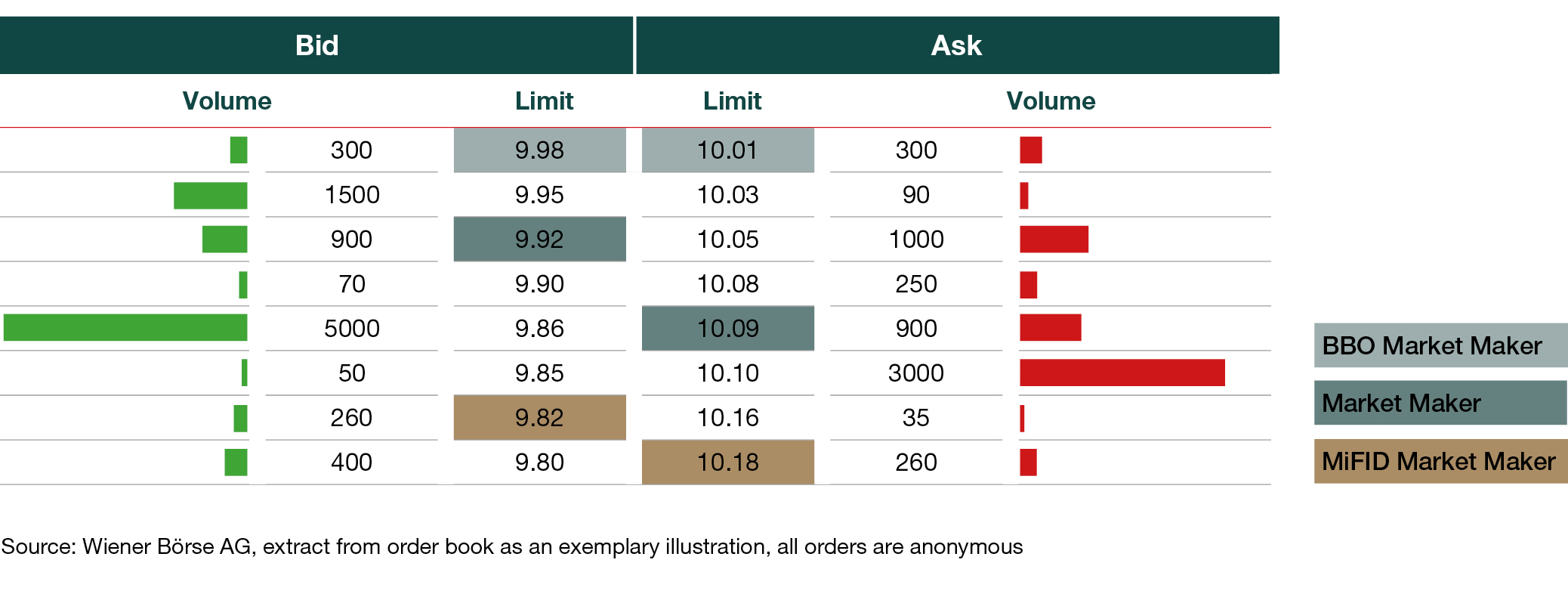

In this trading procedure, there can be up to three different liquidity providers for each instrument:

Market Maker

Market makers are trading participants who provide binding bid and ask prices in securities trading. Any trading participant may become a market maker by entering into a binding quotation obligation a security. There may be more than one market maker per instrument.

Market makers on the Vienna Stock Exchange pledge to meet certain quotation requirements, which depend on the market segment – such as the equity market (including the segments prime market, standard market, direct market plus & direct market, and global market), the bond market (with the segments public sector, corporates prime & corporates standard, financial sector), and structured products (exchange traded funds, in short: ETFs).

One key criterion is time. Market makers must be present in the trading system with binding bids and offers for at least 80 percent of the daily observation period (from 9:00 a.m. to 5:30 p.m.) on a monthly average. Lower requirements apply to shares in the global market and ETFs (50 percent or, if the market maker represents at least 40 percent of the total trading volume, 25 percent of the daily observation period).

In addition, minimum sizes have been set that market makers must provide in their buy and sell offers. Depending on the market segment and liquidity class, these range between EUR 7.500 and EUR 35.000. For bonds, a minimum nominal value of EUR 10.000 is required.

Another important criterion is the maximum spread, i.e., the difference between the buy and sell limits. There are also clear limits here, ranging from 0.65% to 5% depending on the market segment and liquidity class. For bonds, a fixed value of 500 basis points is specified for the maximum spread.

MiFID Market Maker

Trading participants who engage in algorithmic trading in a security to pursue a market-making strategy according to RTS 8 Article 1 of Delegate Regulation (EU) 2017/578 and shall apply becoming a MiFID Market Maker on Wiener Börse. They are also subject to minimum requirements in terms of time, spread, and quantity, which are, however, lower than those for market makers. There may be more than one MiFID market maker per instrument.

MiFID market makers on the Vienna Stock Exchange commit to complying with certain quotation requirements in various market segments, such as the equity market (which includes the prime market, standard market, direct market plus & direct market, and global market segments) and structured products (exchange traded funds, in short: ETFs). These requirements are less stringent than those for market makers.

A key criterion is time. MiFID market makers must be present in the trading system with binding bids and offers for at least 50 % of the daily observation period (from 9:00 a.m. to 5:30 p.m.) on a monthly average.

Furthermore, a minimum size has been set that MiFID market makers must provide in their buy and sell offers. This is EUR 2.500.

Another important criterion is the maximum spread, i.e., the difference between the buy and sell limits. This is twice the maximum spread of the market maker for the respective instrument, but no more than 5%.

BBO Market Maker

Trading participants who take part in the Wiener Börse Best Bid and Offer program. As BBO Market Makers, trading participants are obliged to place quotes for the instruments within a basket. This obligation applies to the entire basket, but not to individual instruments. There may be more than one BBO Market Maker per basket.

BBO market makers on the Vienna Stock Exchange agree to meet certain quotation requirements for the ATX basket (consisting of all stocks included in the ATX) and/or the non-ATX basket (including all stocks listed on the Vienna Stock Exchange's prime market but not included in the ATX).

A key criterion is time, whereby various fulfillment levels are provided for. Depending on the fulfilment level, BBO market makers must be present in the trading system on a monthly average basis for at least 5%, 10% or 20% of the daily observation period (9:00 a.m. to 5:30 p.m.) with the best bid and/or ask price for shares in the ATX basket or non-ATX basket. A basis of 80% of the shares in the ATX Basket or 60% of the non-ATX Basket is used to fulfill the BBO market maker obligation.

In addition, a minimum size has been set that BBO market makers must provide in their buy and sell offers. Depending on the fulfillment level, this is EUR 2.000, EUR 3.000, or EUR 5.000 for shares in the ATX basket and EUR 1.000, EUR 1.500, or EUR 2.500 for shares in the non-ATX basket.

In specific market situations (e.g., high market volatility, stressed market conditions, exceptional circumstances), the Wiener Börse may temporarily waive or reduce the quotation obligation for liquidity providers.

Auction and Continuous Auction

In these trading procedures, instruments can also have (a) liquidity provider(s):

- Liquidity providers in trading procedure Auction

- Liquidity providers in trading procedure Continuous Auction