(Vienna) While global stock markets are under pressure following interest rate hikes and geopolitical tensions, equity trading volumes on the Vienna Stock Exchange stabilised at pre-crisis levels in the third quarter 2022. The one-off effect of the Russia-Ukraine war pushed the equity trading volume for the year 2022 to EUR 58.28 billion, 6% above the previous year's level. With Optiver, a new trading member joined the Vienna Stock Exchange in the last quarter. The issuance markets are challenging due to the market situation. In bond listings, the Vienna Stock Exchange is defying the general trend with high new listings.

"Patience is an essential ingredient for successful investments. Historically, equities are the most profitable asset class, but only for those who persevere in times of declines. As successful global players in niche industries, Austrian stocks belong into any well diversified European portfolio. Europe needs to focus on strengthening public markets. Private capital is urgently needed to foster innovation, transform our economy and ensure future growth,” says Christoph Boschan, CEO Wiener Börse AG.

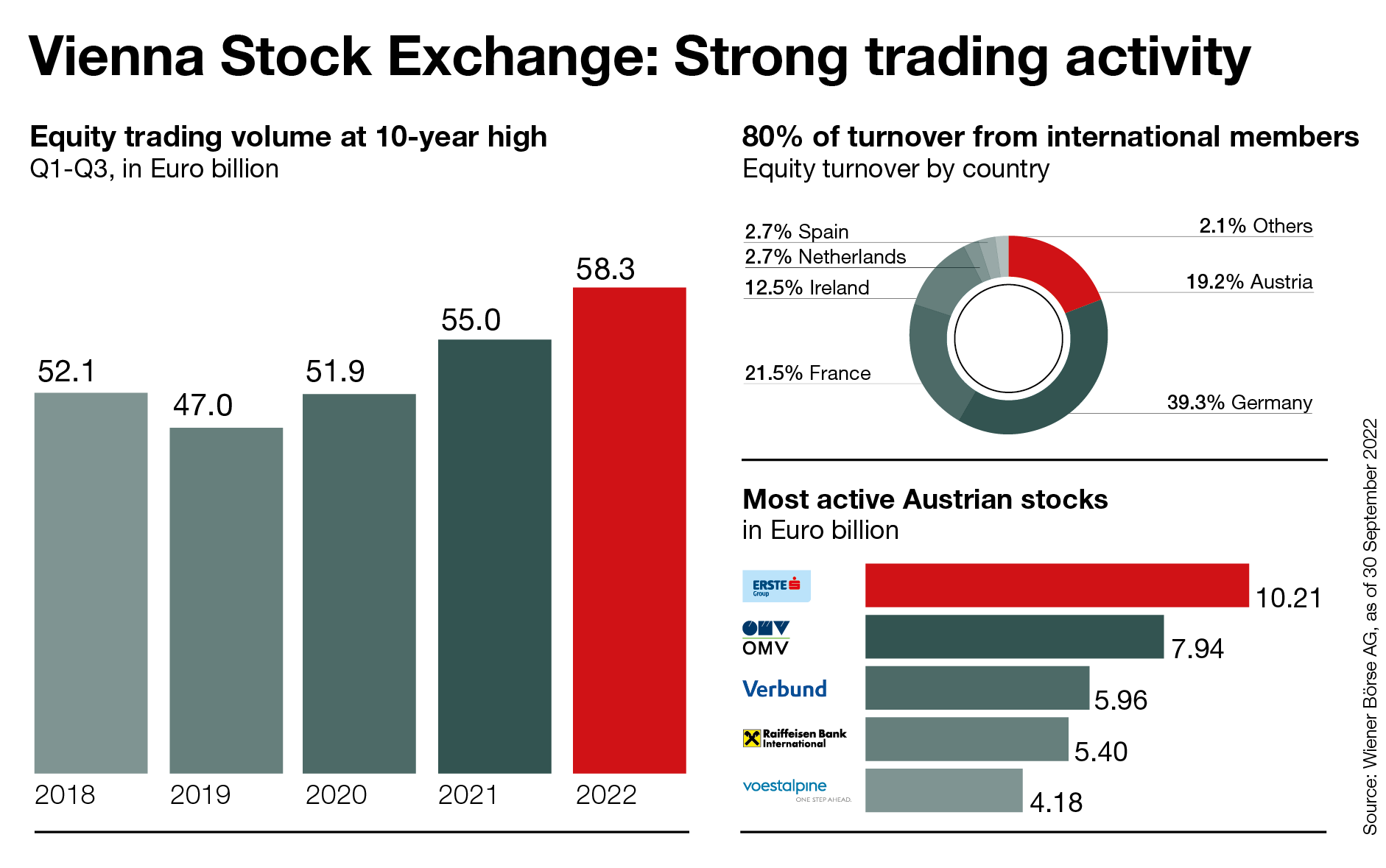

Equity turnover still at 10-year high

After a very strong first quarter marked by high volatility, equity turnover settled at pre-crisis levels at EUR 15.5 billion in the third quarter. The third quarter of 2022 had 66 trading days. 16 September 2022, a triple witching day, was the strongest trading day with EUR 649 million. On an average trading day, EUR 235 million in turnover was recorded.

In the course of the year, trading participants turned over EUR 58.28 billion in equity securities. This is six per cent more than in the previous year (Q1-Q3 2021: EUR 54.96 billion). International exchange members accounted for 80% of the turnover. With Optiver, a new international trading member connected to the Vienna Stock Exchange in September. The most active Austrian stocks were Erste Group Bank AG (EUR 10.21 billion), OMV AG (EUR 7.94 billion), Verbund AG (EUR 5.96 billion), Raiffeisen Bank International AG (EUR 5.40 billion) and voestalpine AG (EUR 4.18 billion).

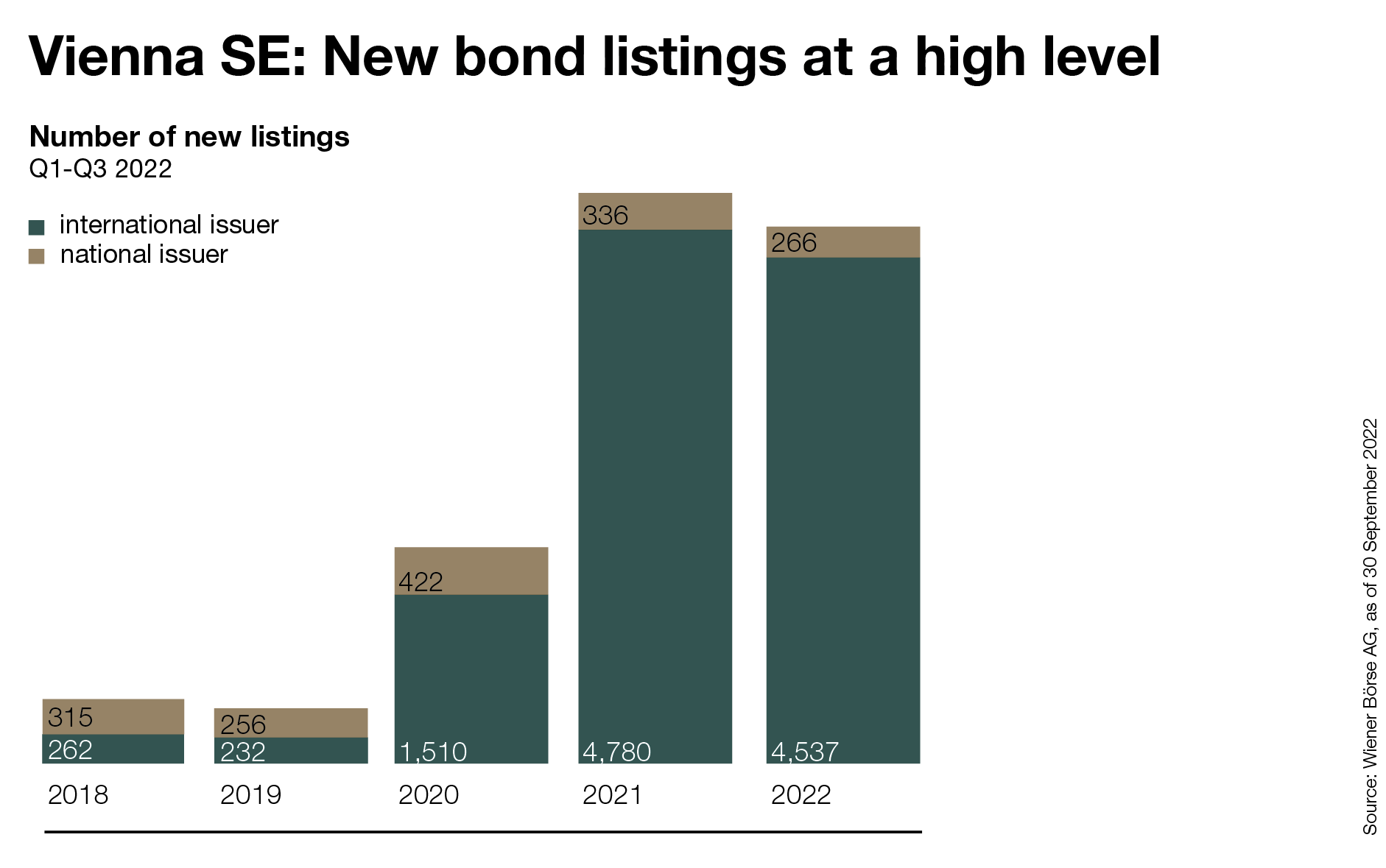

Vienna Stock Exchange among the most active European listing venues for bonds

In a challenging issuance market, the Vienna Stock Exchange was able to maintain a high number of new bond listings. With 4,803 mostly international new listings in the course of the year, the Vienna Stock Exchange ranks among the top bond listing venues in Europe. The high level of the previous year was maintained under difficult market conditions. The number of new international clients increased by one third.

Patient investors are rewarded in the long run

Worldwide, the developed stock markets showed double-digit price declines in the course of the year. After the Austrian national index ATX, including dividends, gained 43.59% in the previous year, it lost 27.63% year-to-date. On 30 September 2022, the ATX TR stood at 5,680.36 points (ATX without dividends - 30.28%, 2,691.95 points). When comparing between indices and countries, one should always keep an eye on the sector composition. Due to its cyclical composition with heavyweights in the financial sector and basic industry, the ATX swings strongly in both directions in volatile market phases. In the long term, however, the return is around the European average of 6%.

Four Austrian prime market companies defied this year's global downward trend: Schoeller-Bleckmann Oilfield Equipment AG (+45.07%), Flughafen Wien AG (+24.25%), STRABAG SE (+5.32%) and S Immo AG (+4.37%) are all up for the year. The market capitalisation of all domestic companies listed in Vienna was EUR 104.88 billion as of 30 September 2022.

Education is the best investor protection and pays off

In addition to the existing financial literacy initiatives (stock market academy, teacher’s workshops and teaching material for high school students, the Vienna Stock Exchange launched a new initiative. Commissioned by Vienna Stock Exchange, a team of teachers developed new teaching material for secondary level I ("Unterstufe"). Three e-books (digital or printed on order), a board game with digital action cards and a crossword puzzle are available free of charge.

Infographics on stock trading & new bond listings for download

For further information, please contact:

Julia Resch

Head of Corporate Communications & Marketing, Spokesperson

julia.resch(a)wienerboerse.at

+43 1 531 65-186

About Wiener Boerse

As the main provider of market infrastructure in the region, Wiener Börse AG is the gate to global markets. Operating the stock exchanges in Vienna and Prague, the group offers state-of-the-art systems, information and IT services. Listed companies receive maximum liquidity and investors benefit from fast and cost-effective trading by the market leader. Wiener Börse AG also collects and distributes stock market data and calculates the most important indices of the region. Because of this unique know-how the national stock exchanges in Budapest, Ljubljana and Zagreb trust its IT services. Additionally, the group holds stakes in energy exchanges and clearing houses.

Exclusion of Liability

This press release may contain certain forward-looking statements and forecasts that are based on assumptions current made at the time of publication of this press release. We do not assume any liability for these forward-looking statements materializing. Furthermore, we would like to explicitly point out that this press release cannot serve as a basis for investment decisions and may not be construed as a solicitation to buy or a recommendation to invest by Wiener Börse AG. No liability is assumed for the information given in this press release.