(Vienna) The first quarter of 2023 was characterised by a market recovery, despite uncertainties that aroused in the banking sector in March. Equity turnover normalised to pre-pandemic levels at EUR 17.1 billion. Since March, AUSTRIACARD HOLDINGS AG has been listed in the top segment prime market, which has grown to 41 stocks. Wolford AG used the market for a capital increase (EUR 17.6 million). In the bond segment, new listings remained at a high level, and green & social bonds have recorded the strongest quarter since the launch of the Vienna ESG segment.

"For equity financing, the changed interest rate situation offers positive perspectives. Going public is becoming increasingly attractive. In addition to the successful newcomer Austriacard Holdings, another listing in the top segment has already been announced for this year in the form of the spin-off of Telekom Austria," says Christoph Boschan, CEO of Wiener Börse AG, looking ahead to 2023 with confidence. "With the modernisation of the central data feed, the Vienna Stock Exchange has completed an important infrastructure project. As a well-diversified exchange provider, we offer optimal infrastructure and services to all capital market participants."

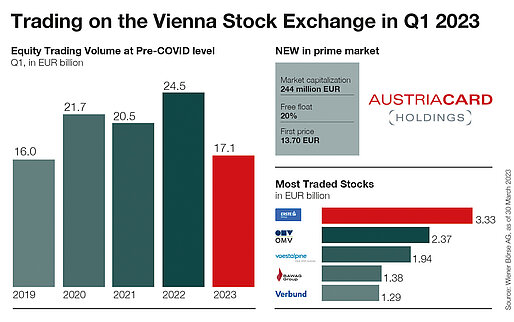

Equity turnover returns to pre-COVID level

After three years of strong one-off effects, equity turnover in Q1 2023 settles back above 2019 levels. From January to March 2023, trading participants generated EUR 17.1 billion in equity trading volume (Q1 2022 EUR 24.5 billion). The strongest trading day was 17 March (EUR 640 million), with EUR 316 million traded on an average trading day. International trading members were responsible for the lion's share (87%). The most actively traded Austrian stocks were Erste Group Bank AG (EUR 3.33 billion), OMV AG (EUR 2.37 billion), voestalpine AG (EUR 1.94 billion), BAWAG Group AG (EUR 1.38 billion) and Verbund AG (EUR 1.29 billion).

"To make our economy fit for the future, Europe needs innovation, which can only be financed by equity. Economies with developed capital markets grow more strongly and will transform more quickly. The fact that meanwhile every fourth person in Austria owns securities and every fifth is interested in buying them shows that the topic is firmly rooted in the middle of Austrian society," says Christoph Boschan.

The "Aktienbarometer", a recent survey commissioned by the Aktienforum, the Federation of Austrian Industries and the Vienna Stock Exchange, confirms a growing number of shareholders in Austria. Broken down to the individual asset classes, 19% invest in investment funds, 13% in shares and 6% in bonds. The survey also highlights considerable potential, as more than one million people are interested in investing in securities.

Slight recovery in the ATX year-to-date

The Austrian stock market set off on a rally in 2023. Uncertainties surrounding the banking sector boosted turnover in March and caused a temporary setback in the performance of the national index. Year-to-date, the ATX TR (incl. dividends) gained 3.02% and held at 6,796.27 points on 31 March 2023 (ATX without dividends +2.66%, 3,209.44 points). In comparison with other country indices, attention should be paid to the focus on banks and commodities in the ATX composition.

A look at the ATX Global Players reveals the strength of the Austrian companies that lead the world market in their field: the index rose by 15.47% year-to-date. The strongest winners in the Austrian prime market are global market leaders: Lenzing AG (+26.83%), voestalpine AG (+26.23%), Semperit AG Holding (+25.13%), FACC AG (+23.99%), and Flughafen Wien AG (+22.10%). All Vienna-listed companies have a market capitalisation of EUR 120.16 billion as of 31 March 2023.

Bonds: Most active quarter in the Vienna ESG Segment

In the bond segment, the Vienna Stock Exchange recorded the strongest inflow in sustainability bonds in the first quarter since the Vienna ESG Segment was founded. These include covered bonds of UniCredit Bank Austria (EUR 750 million, 23-29), Hypo Vorarlberg Bank (EUR 500 million, 23-26), Erste Group Bank (EUR 750 million, 23-31), Volksbank (500 m, 23-27), Hypo Tirol Bank (EUR 300 million, 23-28). With a total of 1,711 new and 13,758 existing listings at the end of the quarter, the Vienna Stock Exchange maintained its position as the most active debt listing venue in Europe.

A new guide on sustainability reporting supports listed companies and potential stock exchange candidates in dealing with the growing requirements and opportunities in the areas of environmental, social and responsible corporate governance (ESG).

Infographics on stock trading for download

About Wiener Boerse

As the main provider of market infrastructure in the region, Wiener Börse AG is the gate to global markets. Operating the stock exchanges in Vienna and Prague, the group offers state-of-the-art systems, information and IT services. Listed companies receive maximum liquidity and investors benefit from fast and cost-effective trading by the market leader. Wiener Börse AG also collects and distributes stock market data and calculates the most important indices of the region. Because of this unique know-how the national stock exchanges in Budapest, Ljubljana and Zagreb trust its IT services. Additionally, the group holds stakes in energy exchanges and clearing houses.

Exclusion of Liability

This press release may contain certain forward-looking statements and forecasts that are based on assumptions current made at the time of publication of this press release. We do not assume any liability for these forward-looking statements materializing. Furthermore, we would like to explicitly point out that this press release cannot serve as a basis for investment decisions and may not be construed as a solicitation to buy or a recommendation to invest by Wiener Börse AG. No liability is assumed for the information given in this press release.