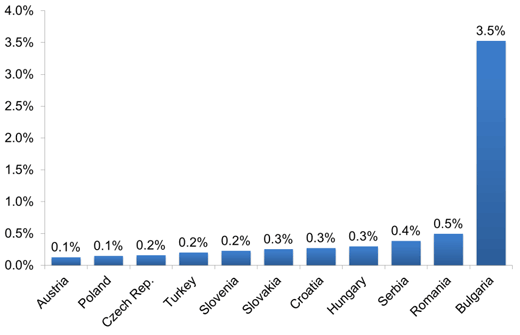

Greece remains a key unknown for the region. The good news, however, is that fundamentals indicate little reason for contagion and, more importantly, markets have remained reasonable. Yields have been up, but spreads for both EUR-periphery as well as the region have risen only slightly. Apart from imbalances being in check, regional trade links with Greece are minor. Bulgaria stands out here with the highest exposure, via its banking sector, joined by Romania.

CEE trade links with Greece (exports/GDP, 2014)

Source: Datastream, national statistics

We would argue that yields have started to rise for a good reason, with expectations on inflation and (finally) nominal growth behind the weaker bond prices. This matches our theme of CEE posting a strong economic recovery, even outperforming other emerging markets. EM overall have started to post some signs of recovering growth as well, despite increasing concerns on China.

This appears to be important, since we feel that only increasing interest in EM overall can help ease the region’s bottleneck, which is liquidity. Indeed, liquidity momentum is rising and country flows indicate some improvement. In order to close the performance gap of emerging Europe to DM and EM overall, we still need more of this, though.

Valuation has come down somewhat, while growth remains sound. More important, however, is that the EPS consensus trend has finally bottomed out, indicating a sustainable growth recovery, not merely driven by the effects of a low base. We believe that this is important, since it will help to keep equity attractive relative to rising bond yields, while adding a new driver.

In our allocation proposal, we reflect the fact that quite a few regional markets have become political. A positive impact is visible in Hungary, finally showing reduced banking sector taxes in next year’s budget. Poland recently joined a well, once the surprise presidential election and subsequent polls indicated that PiS and Pawel Kukiz’s party are in the lead for the elections in October. Immediately jumping into their campaigns, both came up with plans to add sector taxes, namely on banks. While we still see stock-picking ideas in Poland, we would rather overweight Hungary, the Czech Republic and Austria against the Polish market. Turkey has been in a political mode for a while already. If a coalition is formed by mid-August, we would instantly become more positive about the market, but remain neutral for the time being. Croatia seems to be on the brink of finally leaving its recession, creating a recovery story as a laggard. Romania, with its good macro story, might suffer from its assumed exposure to Greece via banks. While we see this as overdone, it should keep the market under wraps.

Author:

Fritz Mostböck, CEFA

Head of Group Research

Erste Group Bank AG

6 July 2015

Note

Wiener Börse AG would explicitly like to point out that the data and calculations given in this report are historic values, which do not permit any conclusions as regards future developments or value stability. Price fluctuations and loss of capital are possible in securities trading. The contribution is the personal opinion of the analyst and does not constitute a financial analysis or a recommendation for investment by the exchange operating company, Wiener Börse AG.