The volatility interruption contributes significantly to preventing abrupt, unintended price jumps and plays an important role in ensuring price quality.

Volatility interruption – often referred to as a "circuit breaker" – is an essential component of the Xetra® T7 trading system and an important protective mechanism for the trading procedures "Continuous Trading with Auctions" and "Auction".

Triggering a volatility interruption

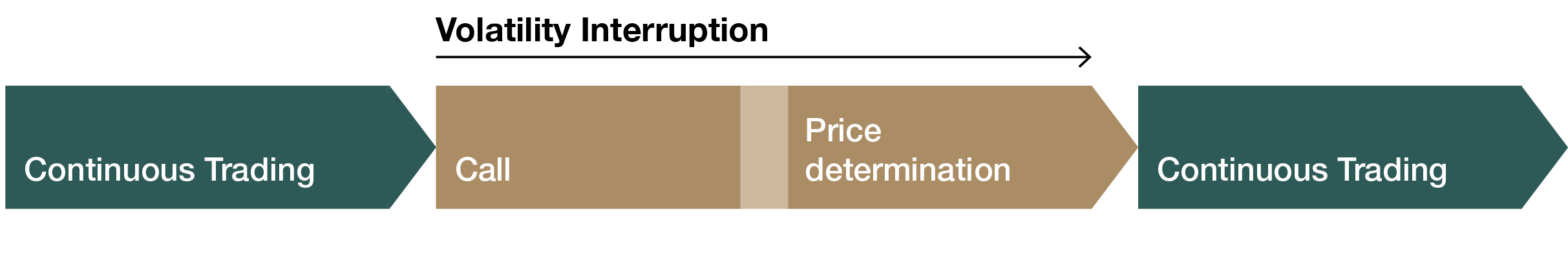

A volatility interruption is triggered when the next potential price (indicative price) of a security lies outside the specified dynamic or static corridor. The price gets not determined immediately; instead, trading is interrupted for a certain time (= volatility interruption) – the duration varies depending on the trading procedure and market segment (e.g., 2 minutes in continuous trading). If this occurs during continuous trading, the call phase of a volatility interruption is initiated; during an auction, it leads to an extension of the call phase. A volatility interruption is always indicated in the trading system and marked accordingly.

During a volatility interruption

The breather gives market participants (investors) more time to analyze the actual situation. Another benefit is that orders are collected until the next price determination gets started which further bundles liquidity. Up until the next price determination, new orders can be placed, existing orders can be adjusted (e.g., price or quantity), or deleted, so the potential price may still change until the end of the interruption.

Conclusion of a volatility interruption

At the end of a volatility interruption, prices are determined – as in a regular auction – according to the most executable volume principle, i.e. the price is determined from the sum of buy and sell orders where, taking all orders into account, the largest (unit-) turnover is possible.

After the scheduled duration of the volatility interruption has expired, price determination will be again started. If the indicative price is now within the specified limits, the interruption can be successfully ended with a price determination, and the security automatically enters the next scheduled trading phase in the trading system.

When prices jump significantly, trading may remain interrupted for an additional time due to an extended volatility interruption. If this happens, the Wiener Börse monitors the price movements even more closely, manually triggers the price determination and moves the security to the next trading phase in the trading system.

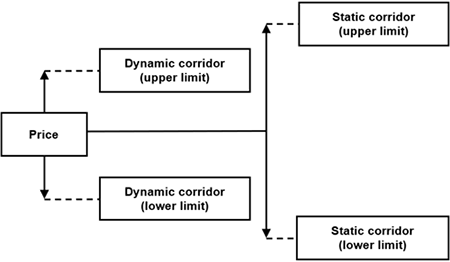

The dynamic and the static corridor

All securities in the trading procedures "Continuous Trading with Auctions" and "Auction" have a dynamic and a static corridor.

The dynamic corridor defines the maximum (symmetrically positive or negative) deviation of a security from the last traded price (including price without turnover).

The static corridor defines the maximum (symmetrically positive or negative) deviation of a security from the last price traded in a(n) (volatility-)auction (including the price without turnover).

A volatility interruption is triggered when the next possible price of a security exceeds the defined dynamic or static corridor.

On Wiener Börse, the range of the corridors is based on the type of security (e.g., stock, bond), the trading procedure, the available liquidity providers (e.g., market makers), market volatility, and the liquidity of the security. The corridors are determined individually for each security, reviewed at least once a month, and adjusted if necessary.

The actual values of the dynamic and the static corridor for each security tradable on the Wiener Börse can be found here:

Current corridor values (csv-file)