- Trading volume up by 15% to EUR 19.13 billion in Q1 2018

- Most active stocks: Erste Group, OMV, Raiffeisen Bank International

- All-time high in tradable equities

- Record in price data dissemination on 6 February

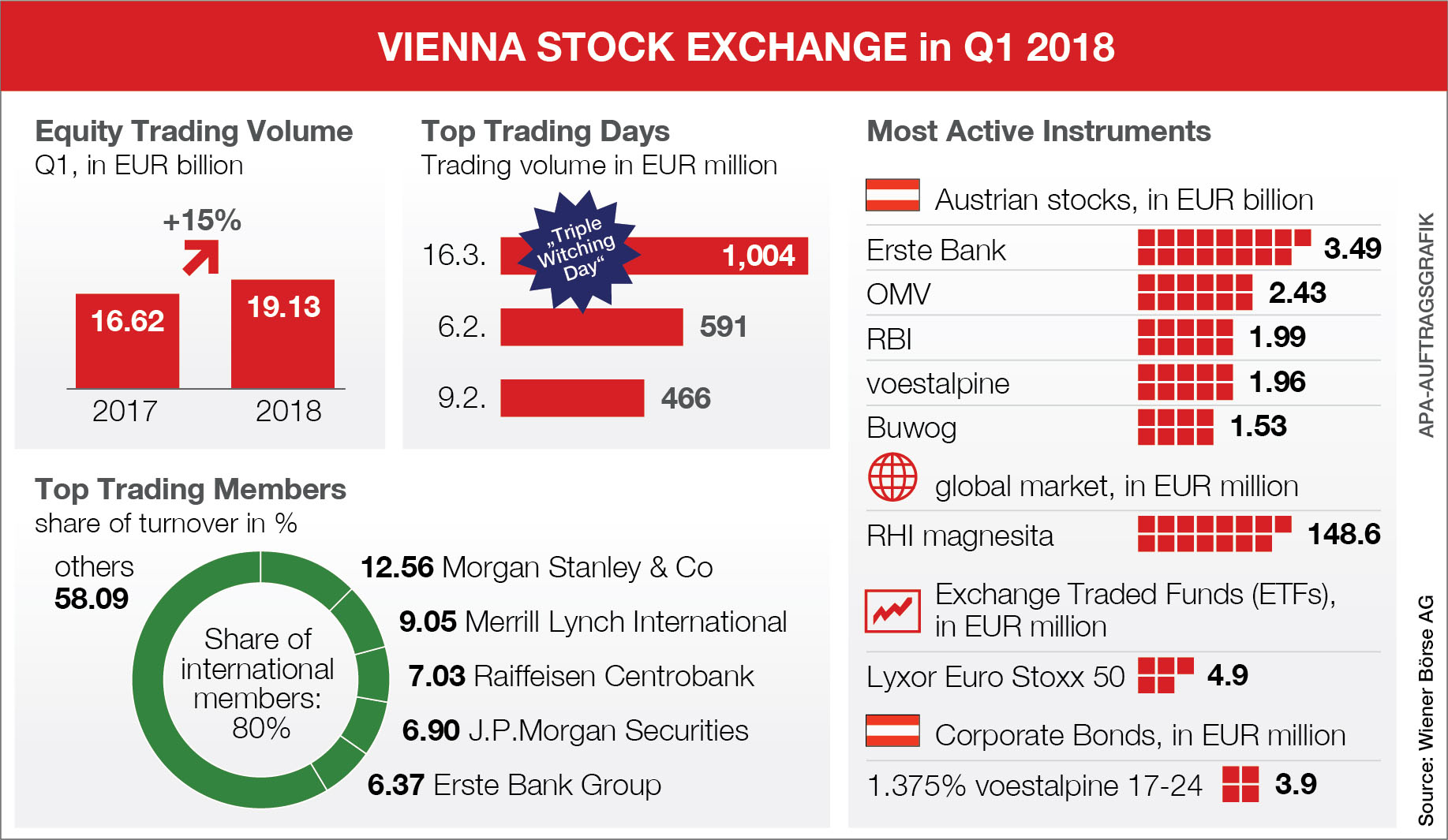

(Vienna) In the first quarter of 2018, the Vienna Stock Exchange attained an equity trading volume of EUR 19.13 billion. This is a gain of 15% year on year (Q1 2017: EUR 16.62 billion). The average monthly trading volume was around EUR 6.38 billion in Q1 2018. Apart from continuous trading, auction trading also developed very well on the Vienna Stock Exchange. Auction trading recorded steep gains in trading volume: since the start of the year, more than every third order was executed in auction trading. The enlargement of the global market segment has created the largest selection of stocks ever for domestic investors on the Vienna Stock Exchange. With more than 570 tradable equities, more shares (and equity-linked certificates) are tradable in Vienna than ever before.

"Our strategy is reaping success. On the one hand, we offer the most liquid marketplace for domestic stocks – as also recently confirmed by ESMA – and, on the other, we enable trading in international stocks in Vienna at the best of terms. Our trading volumes show that our wider range of offerings has been well received by investors," said Christoph Boschan, CEO of Wiener Börse AG.

Most active stocks and trading members

The most active Austrian stock was Erste Group Bank AG with EUR 3.49 billion ahead of OMV AG with EUR 2.43 billion and Raiffeisen Bank International AG with EUR 1.99 billion. In fourth and fifth place were voestalpine AG (EUR 1.96 billion) and BUWOG AG (EUR 1.53 billion). The most frequently-traded stock on the global market was RHI Magnesita N.V. with EUR 148.6 million. On the ETF segment, LYXOR ETF EURO STOXX 50 was the most active instrument (EUR 4.9 million). The voestalpine bond 2017 -2024 with a coupon of 1.375% was the most frequently-traded corporate bond (EUR 3.9 million).

The majority of equity trading (over 80%) is generated by international trading members. A ranking of trading members by share in turnover places Morgan Stanley & Co at the top at 12.56%, ahead of Merrill Lynch International (9.05%) and Raiffeisen Centrobank AG (7.03%). J.P. Morgan Securities plc (6.90%) and Erste Group Bank AG (6.37%) came in fourth and fifth in the ranking.

Strongest trading days and all-time high on data highway

At just over one billion euro in daily trading volume, the strongest trading day in the first quarter was 16 March, the so-called triple witching day (quarterly expiry day for futures and options). Second in ranking was 6 February (EUR 591 million) and third was 9 February (EUR 466 million), two days on which stock markets worldwide – especially the in U.S. – posted high volatility.

In the first quarter, the market datafeed of the Vienna Stock Exchange hit an all-time high in price data dissemination for the ten markets of the region. Never before had so many price updates been disseminated via the central price data highway of Vienna to end customers in a total 68 countries worldwide. Throughout Europe, a total of 80 trading participants and some 250 data customers rely on the services of the Vienna Stock Exchange.

"The Vienna Stock Exchange is constantly investing in IT innovation in order to maintain its central system infrastructure in excellent working order, and to stay one step ahead of the growing volumes of data. In the past few years, we have been able to offer our customers the highest level of system availability," stressed Ludwig Nießen, COO & CTO of Wiener Börse AG.

Statistics: Price movements, winners & losers in the leading ATX index

While the major leading European indices slipped into negative territory, the ATX has been on a sideways trend since the start of the year with a gain of 0.25% (+0.47% incl. dividends). The Austrian leading index stood at 3,428.53 points on 29 March 2018. (All-year high on 23 January 2018: 3,688.78 points; all-year low on 9 February 2018: 3,354.12 points). With a price gain of 28.86% since the start of the year, FACC AG was the best performer in the ATX, followed by Verbund AG with +17.15% and Erste Group Bank AG with a gain of 13.00%. On the prime market, Valvena SE (+31.09%), Wolford AG (+10.25%) and Do & Co AG (+9.06%) were the top non-ATX performers. Market capitalization of all domestic companies listed on the Vienna Stock Exchange was EUR 133.30 billion on 29 March 2018. In February 2018, the highest level since June 2008 was attained at EUR 135.31 billion.

"Driven by the bull markets, market capitalization developed well in historic comparison. If one compares market capitalization to gross domestic product, Austria ranks rather poorly in European comparison. The intensive use of the capital market could act as stimulus for the domestic economy. We are currently engaged in intensive talks with the Austrian government to recognize and develop unexploited potentials," said Christoph Boschan.

Details on the individual market segments, indices and securities are available on our web statistics page. A comparison of European stock exchanges is available in the statistics published by the Federation of European Securities Exchanges (FESE).

Download info graphic (jpg-file 320 KB)

For further information, please contact:

About the Vienna Stock Exchange

The Vienna Stock Exchange is the only securities exchange in Austria. It features a modern infrastructure and supplies market data and relevant information. It offers Austrian companies maximum visibility, high liquidity and utmost transparency. Investors can rely on the smooth and efficient execution of exchange trades. The Vienna Stock Exchange operates a central market datafeed for Central and Eastern Europe (CEE) and is well established as an expert for the calculation of indices with a reference to the region. Wiener Börse AG, together with its holding company, CEESEG, cooperates with over ten exchanges in CEE and is globally recognized for this unique know-how.

Exclusion of Liability

This press release may contain certain forward-looking statements and forecasts that are based on assumptions current made at the time of publication of this press release. We do not assume any liability for these forward-looking statements materializing. Furthermore, we would like to explicitly point out that this press release cannot serve as a basis for investment decisions and may not be construed as a solicitation to buy or a recommendation to invest by Wiener Börse AG. No liability is assumed for the information given in this press release.