After an increase of 1.5% in 2016, the Austrian economy should record an even higher growth rate this and next year. The most important factors of the acceleration are the improved domestic demand and strong economic activity in our neighbouring countries, i.e. the Czech Republic, Slovakia, and Hungary, and not the least in Germany, our main trading partner.

After an increase of 1.5% in 2016, the Austrian economy should record an even higher growth rate this and next year. The most important factors of the acceleration are the improved domestic demand and strong economic activity in our neighbouring countries, i.e. the Czech Republic, Slovakia, and Hungary, and not the least in Germany, our main trading partner.

The Erste Group Research analysts expect a significant increase in inflation. After 0.9% in 2016, the Consumer Price Index should rise to 1.6% (2017) and 1.8% (2018), respectively. The public budget benefits from the favourable economy and from a decline in interest expense; government debt in terms of GDP is receding. In spite of these positive conditions, the budget is expected to remain in deficit (-1.2% in terms of GDP) due to the rather more expansive fiscal policy.

| 2016 | 2017 expected | 2018 expected | |

|---|---|---|---|

| Real GDP in % | 1.5 | 1.9 | 1.7 |

| Inflation rate (CPI) in % | 0.9 | 1.6 | 1.8 |

| Unemployment rate in % | 6.0 | 6.2 | 6.1 |

| Budget deficit in % of GDP | -1.6 | -1.2 | -0.9 |

| Government debt in % of GDP | 84.6 | 80.9 | 78.6 |

Sources: Statistics Austria, BMF, Erste Group Research

ECB maintains its monetary policy for the time being

Whereas the Fed increase its Fed funds rate again slightly in March, the ECB is not expected to change its monetary policy for the time being. The development of core inflation is an important factor for the ECB. Most recently, the core inflation in the Eurozone has fallen from 0.9% to 0.7%. Due to the robust economy, some market participants expect a possible trend reversal of the ECB in terms of interest rate and monetary policy in 2018. In the USA, two further interest rate hikes are expected for this year.

Cyclicals and financials preferred

The cyclical recovery of the economy and the relatively steep interest rate curve have caused the demand for cyclical equities and bank shares to rise. Companies in the construction industry and those depending on that industry benefit from the good construction cycle. And more generally, the good economic activity supports the credit business in the banking sector.

ATX with relatively high dividend yield of 3.3%

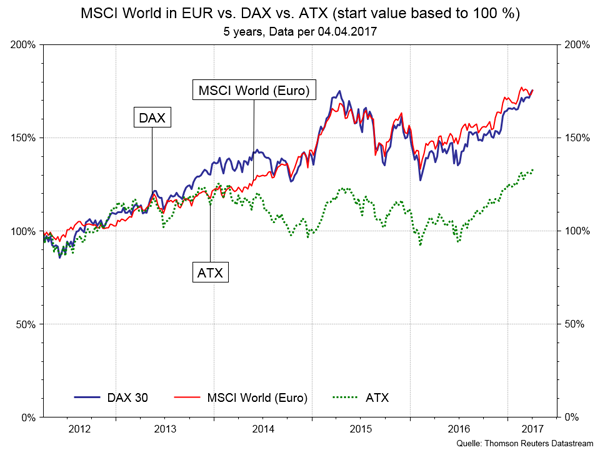

Global equity markets have benefited from the recovered world economy and from increasing inflation rates (“reflation trade”). Q1 2017 should have come with very positive ramifications overall for company earnings and economic growth.

The ATX, i.e. the main index of the Vienna stock exchange, recorded a significant increase on a year-on-year basis. At about +24%, it even outperformed the Nasdaq (+21%), Germany’s-DAX-Index (+23%), and the global developed stock exchanges (+12%).

The issues ahead, i.e. Trumponomics, the imminent Brexit negotiations, and the political risks and large economies such as France due to the imminent elections, will continue to stick with the markets. So far, market participants have failed to attach much importance to political risks. If the economic indicators were to weaken again, this might change quickly.

Some market participants expect the markets to correct due to the positive development of the global stock exchanges. But as long as the economy remains strong and companies meet or exceed the expectations of analysts, equities remain the investment vehicle of choice for investors. This is particularly true for the ATX index, which at a dividend yield of 3.3% (as of 31 March 2017) is clearly preferable to government bonds.

Performance of the ATX index, DAX index, and MSCI World index (-5Y; as of 4 April 2017)

Author:

Paul Severin

Head of Communications Erste Asset Management

Member of the board of OVFA

6 April 2017

![[Translate to English:] Erste Asset Management Logo Erste Asset Management](/uploads/u/cms/_processed_/e/0/csm_erste-asset-management-logo_6ec18ee192.gif) |  |

Note

Wiener Börse AG would explicitly like to point out that the data and calculations given in this report are historic values, which do not permit any conclusions as regards future developments or value stability. Price fluctuations and loss of capital are possible in securities trading. The contribution is the personal opinion of the analyst and does not constitute a financial analysis or a recommendation for investment by the exchange operating company, Wiener Börse AG.