- US institutional investors top for 7 years

- Top institutional investors: sovereign wealth funds Norges (NO), Vanguard Group (USA) and BlackRock Fund Advisors (USA)

- Corporate growth dominant investment strategy - Passive asset managers on the advance

(Vienna) International institutional investors remain the largest investor group in the ATX Prime in 2018. Institutional investors hold a total of 65.3%, the rest is held by domestic private investors (18.4%) and non-financial companies (16.3%). Among the institutional investors, US investors are the most loyal investor group. In absolute terms, they invested EUR 6.62 billion in Austrian stocks at the end of 2018. This is confirmed by the latest Ipreo study commissioned by the Vienna Stock Exchange, the results of which were presented at the conference "Thinking AUT Loud | The Sound of Finance" in New York earlier this week. A high-ranking political delegation as well as 24 managers of listed companies addressed investors and American opinion leaders on the spot.

"The Vienna Stock Exchange has the best offer for Austrian companies and global investors. Over the past two years, we have increasingly carried this message out into the world. With effect, as the results of the Ipreo survey show," said Christoph Boschan, CEO of the Vienna Stock Exchange. "However, we have not only worked intensively on increased visibility, but also on our trading quality. International networking is the top priority for a modern stock exchange".

Country ranking of institutional investors

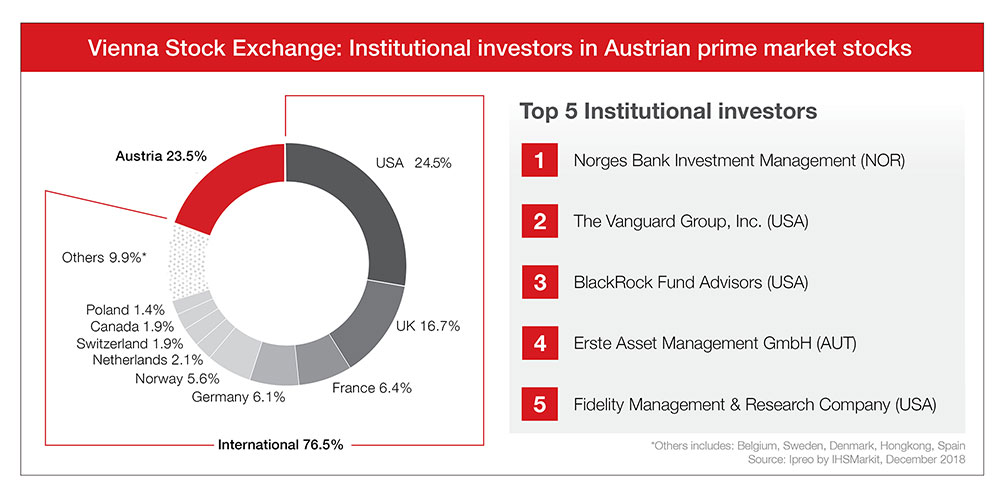

For the seventh time in a row, American investors remain the clear leaders in the country ranking. Their share amounts to 24.5% in 2018. Institutional investors from Austria follow in second place. Their share has risen significantly compared to 2017 and now stands at 23.5% (2017: 20.7%). Despite Brexit's unrest, institutional investors from Great Britain continue to be among the most important investor groups, occupying third place with 16.7% (2017: 15.2%). Investors from France (6.4%), Germany (6.1%) and Norway (5.6%) are also prominently represented.

Norges Bank leading investor in ATX Prime, four US investors in the top 10

The Norwegian sovereign funds of Norges Bank continue to be the most prominent investor in the ATX Prime in 2018. The passive American asset managers The Vanguard Group and BlackRock Fund Advisors rank second and third.

1. Norges Bank Investment Management (Norway)

2. The Vanguard Group, Inc. (US)

3. BlackRock Fund Advisors (US)

4. Erste Asset Management GmbH (Austria)

5. Fidelity Management & Research Company (USA)

6. Erste Sparinvest Kapitalanlagegesellschaft mbH (Austria)

7. J.P. Morgan Asset Management (UK), LTD (GBR)

8. Amundi Asset Management S.A. (France)

9. Dimensional Fund Advisors, L.P. (USA)

10. Raiffeisen Kapitalanlagegesellschaft mbH (Austria)

Corporate growth dominant investment strategy - Passive asset managers on the advance

IPREO also examines which investment strategies institutional investors pursue in the ATX Prime. 35.4% of these investors focus on corporate growth, 30.3% on corporate value. These strategies remained stable compared to the previous year. The global ETF trend does not stop in Vienna either. In 2015, the proportion of institutional investors who invested via an index was still 16.1%, in 2018 it was 18.3%.

Download info graphic (jpg-file 60 KB)

Photo gallery

Video: Thinking AUT Loud | The Sound of Finance

For further information, please contact:

About the Vienna Stock Exchange

The Vienna Stock Exchange is the only securities exchange in Austria. It features a modern infrastructure and supplies market data and relevant information. It offers Austrian companies maximum visibility, high liquidity and utmost transparency. Investors can rely on the smooth and efficient execution of exchange trades. The Vienna Stock Exchange operates a central market datafeed for Central and Eastern Europe (CEE) and is well established as an expert for the calculation of indices with a reference to the region. Wiener Börse AG, together with its holding company, CEESEG, cooperates with over ten exchanges in CEE and is globally recognized for this unique know-how.

Exclusion of Liability

This press release may contain certain forward-looking statements and forecasts that are based on assumptions current made at the time of publication of this press release. We do not assume any liability for these forward-looking statements materializing. Furthermore, we would like to explicitly point out that this press release cannot serve as a basis for investment decisions and may not be construed as a solicitation to buy or a recommendation to invest by Wiener Börse AG. No liability is assumed for the information given in this press release.