(Vienna) Poor financial education is one of the main reasons why Austrians continue to be hesitant when it comes to investing in securities, thus missing out on the few earnings opportunities left, finds the latest study conducted by research firm market on behalf of the Vienna Stock Exchange. For 83% of Austrians, solid financial knowledge is a requisite for investing in stocks. Their opinion is clear: investing money in stocks is a good idea only if you know enough about financial matters. However, only 8% of Austrians assess their own knowledge of economy and finance as very good; it is precisely this knowledge that people need to invest their savings. More than two thirds of the persons surveyed have a hard time finding the right financial product for them.

"Austrian's miss investment chances and lack protection. We have to address the root of the problem. Business education should be part of the curricula in all types of schools and enough time should be dedicated to the subject in the classroom," said CEO of the Vienna Stock Exchange, Christoph Boschan. "Because of a lack of financial education, Austria continues to be a country of savings passbook holders – although in today’s context there is no interest on savings deposits. Shares are currently one of the few ways of investing money to earn returns; figures clearly prove this." The Austrian leading index, the ATX, has gained 6.87% per year over the long term (including dividends). "But only few Austrians profit from this. Education is one of the best investor protection measures and the key to knowledge and competence in this area. It is the foundation for dealing responsibly with one's money and being able to build a nest egg for old age. And it also means more opportunities," explained Boschan.

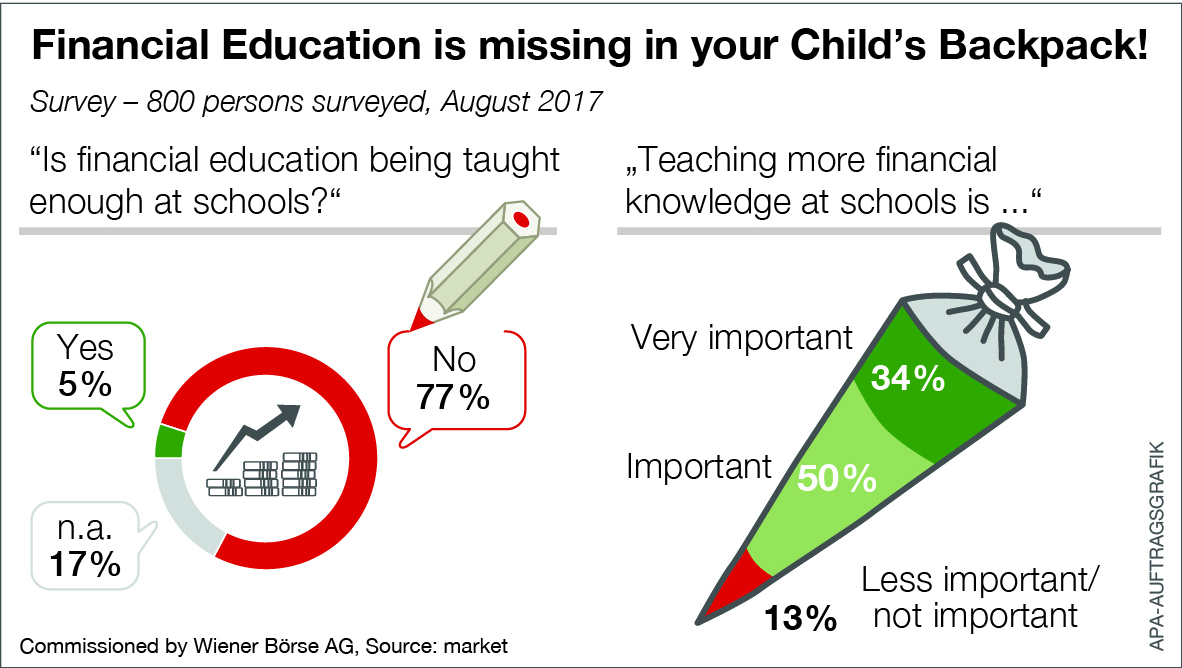

The survey confirmed that Austrians themselves have also acknowledged this problem. 77% of Austrians are of the opinion that there is not enough financial education in schools to equip them to make their own decisions on personal savings for retirement. Even 83% in the age group from 15 to 29 years (still at school or just graduated) believe this. And almost just as many, namely 84% demand that there should be more financial education at school in future.

Well-informed shareholders are good for Austria

Being well-informed about investing is not only good for investors, but also for the domestic economy. Investing money competently improves chances of earning higher returns. Moreover, it also means that Austria’s leading companies benefit from Austrian investors who usually know domestic companies better. This strengthens Austria as a business location and secures jobs. Today, some 400,000 persons work for exchange-listed companies. The contribution to economic output of exchange-listed companies is currently EUR 27.14 billion or around 10% of Austria's GDP. Every euro invested in an exchange-listed company brings EUR 2.3 for the domestic economy.

"We as the Vienna Stock Exchange together with many other representatives of the industry also contribute to the promotion of financial literacy in Austria," stated CEO Boschan. "Supported by teachers we drafted new teaching materials, we convey expert knowledge and didactic methods through seminars and lectures in schools. Our 'Wiener Börse Akademie' offers many further education opportunities for retail investors and professionals alike. But this is only part of the story. Politicians are also called on to also take action," said Boschan.

Investing for all

There is also a need for action from a difference perspective: Only around one in four of the persons surveyed consider shares an investment option for persons with little money. "Low-income people should also be able to take advantage of the opportunities offered by investing in stocks. They need support, because spending on consumption is being reduced in order to accumulate assets," explained Boschan. In this context, the Vienna Stock Exchange has concrete proposals: Exemption from capital yields tax for low-income persons (up to a yearly income of EUR 60.000) and the re-introduction of the exemption from capital yields tax for long-term investments would be suitable measures that can be quickly implemented to promote personal wealth creation.

Lawmakers should also support the establishment of employee foundations. Participation in share ownership through foundations is a benefit for all parties: employees profit from the returns earned; the company benefits from greater loyalty among its employees and secures a strong Austrian core shareholder; this, in turn, strengthens Austria as a good business location. “And all this is in the interest of domestic politicians, after all. The new government will have to deal with the topics of financial education and ways of promoting investment; this demand comes not only from the business sector and the stock exchange, but is also clearly a concern of citizens,” said Boschan.

Download info graphic (jpg-file 320 KB)

For further information, please contact:

About the Vienna Stock Exchange

The Vienna Stock Exchange is the only securities exchange in Austria. It features a modern infrastructure and supplies market data and relevant information. It offers Austrian companies maximum visibility, high liquidity and utmost transparency. Investors can rely on the smooth and efficient execution of exchange trades. The Vienna Stock Exchange operates a central market datafeed for Central and Eastern Europe (CEE) and is well established as an expert for the calculation of indices with a reference to the region. Wiener Börse AG, together with its holding company, CEESEG, cooperates with over ten exchanges in CEE and is globally recognized for this unique know-how.

Exclusion of Liability

This press release may contain certain forward-looking statements and forecasts that are based on assumptions current made at the time of publication of this press release. We do not assume any liability for these forward-looking statements materializing. Furthermore, we would like to explicitly point out that this press release cannot serve as a basis for investment decisions and may not be construed as a solicitation to buy or a recommendation to invest by Wiener Börse AG. No liability is assumed for the information given in this press release.