- ATX gains 14.8% in 3Q

- Equity trading volume 10.4% higher in September 2016 year on year

- 11.5% increase in orders executed through Vienna SE from January till September 2016

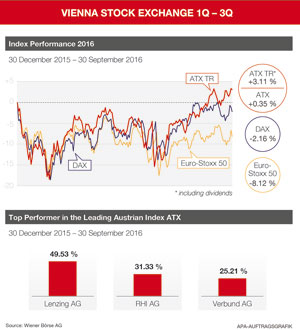

(Vienna) The ATX surged by 14.76% in the third quarter, thereby offsetting the setbacks of the first half-year (including dividends ATX TR: 15.48%). The start of the year 2016 was marked by declining oil prices, the China crisis, worries about the development of the economy and the Brexit surprise. Despite these events, the ATX has risen since the beginning of the year by 0.35%, and the ATX TR by 3.11%. The ATX thus clearly outperformed the YTD performance of the European benchmark index Eurostoxx 50 ( 8.12%). Equity trading volumes on the Vienna Stock Exchange were 10.4% higher in September than in the previous year (09/2015: EUR 4.52 billion; 09-2016: EUR 4.99 billion). Total trading volume on the Vienna Stock Exchange YTD is EUR 42.08 billion (01-09 2015: EUR 44.19 billion). In 2016 to date, executed orders through the XETRA® trading system of the Vienna Stock Exchange increased by 11.5% year on year.

(Vienna) The ATX surged by 14.76% in the third quarter, thereby offsetting the setbacks of the first half-year (including dividends ATX TR: 15.48%). The start of the year 2016 was marked by declining oil prices, the China crisis, worries about the development of the economy and the Brexit surprise. Despite these events, the ATX has risen since the beginning of the year by 0.35%, and the ATX TR by 3.11%. The ATX thus clearly outperformed the YTD performance of the European benchmark index Eurostoxx 50 ( 8.12%). Equity trading volumes on the Vienna Stock Exchange were 10.4% higher in September than in the previous year (09/2015: EUR 4.52 billion; 09-2016: EUR 4.99 billion). Total trading volume on the Vienna Stock Exchange YTD is EUR 42.08 billion (01-09 2015: EUR 44.19 billion). In 2016 to date, executed orders through the XETRA® trading system of the Vienna Stock Exchange increased by 11.5% year on year.

“Vienna Stock Exchange is the most liquid market for Austrian stocks. In a context of declining trading volumes across European stock markets – in some cases steep drops – stock trading on the Austrian capital market has developed quite well. We strive to offer our customers the fastest and most secure execution of securities orders, priced fairly,” said Christoph Boschan, CEO of Wiener Börse AG.

Performance overview

Just like in the first half of the year, Lenzing AG was again the top performer of the ATX posting a gain of 49.53%, followed by RHI AG with 31.33% and Verbund AG with 25.21%. The market capitalization of domestic companies on the Vienna Stock Exchange totaled EUR 86.47 billion on 30 September 2016.

New corporate bonds at end of 3Q

Austrian companies issued 16 new corporate bonds with an outstanding volume of EUR 1.39 billion through the Vienna Stock Exchange as of the end of September. These issues also included the first benchmark bond of an Austrian company in 2016, namely the bonds of Novomatic with a volume of EUR 500 million. The convertible bond issued by BUWOG with a volume of EUR 300 million and trading lots of EUR 100,000 targeted institutional investors. Overall, 30 new corporate bonds with a total volume of EUR 3 billion were floated.

<link file:5519 _blank download "Opens internal link in current window">Download graphic</link> (jpg-file 641 KB)

For further information, please contact:

Julia Resch

<link julia.resch@wienerborse.at>julia.resch@wienerborse.at</link>

T +43 1 531 65-186

Maria Zorn

<link maria.zorn@wienerborse.at>maria.zorn@wienerborse.at</link>

T +43 1 531 65-110

About the Vienna Stock Exchange

The Vienna Stock Exchange is the only securities exchange in Austria. It features a modern infrastructure and supplies market data and relevant information. It guarantees the smooth and efficient execution of stock exchange trades and serves as an intermediary for all market participants. Wiener Börse AG also operates the Austrian power exchange EXAA and the CEGH Gas Exchange under the license of the Vienna Stock Exchange. Wiener Börse AG, together with its holding company, CEESEG, cooperates with 12 exchanges in Central and Eastern Europe and is globally recognized for its unique know-how.